For many Bronx residents, check cashing stores are a lifeline — the stores are how they pay bills and also access money to financially provide for family in their native countries.

However, a proposed regulation by the New York State Department of Financial Services (DFS) would decrease fees charged by check cashing institutions that could cause many to close, leaving thousands of Bronxites without a place to bank.

If adopted in its current form, it would reduce the maximum check cashing fee for government-issued checks from the current rate of 2.27% to 1.5%. This includes checks for social security, unemployment, emergency relief and veterans’ benefits. For all other checks, the maximum cashing fee will drop from 2.27% to 2.2%. The public comment period for this proposed regulation ended Sept. 15. If the proposal is adopted it will go into effect on Jan. 1, 2023, otherwise the department is required to adopt a regulation by June 15, 2023, or refile and begin the process again, according to a DFS spokesperson.

This proposed regulation follows an emergency regulation announced in February, which issued a halt to annual increases and maintained the current maximum check cashing fee at 2.27% while a new fee methodology was being developed. Beginning in January 2023 and every five years thereafter, the industry may request an increase in the maximum fees established.

“As our world evolves, so must our approach to regulation,” said DFS Superintendent Adrienne Harris in a statement. “DFS undertook a data-driven review of the check cashing fee methodology and current maximum fees to understand the impacts of fees on both the industry and New Yorkers, particularly members of immigrant communities and people of color, who depend on check cashers as an essential service to fulfill their financial service‘s needs. We are continually working to promote access to affordable and safe financial products to all communities, while also ensuring the safety and soundness of institutions.”

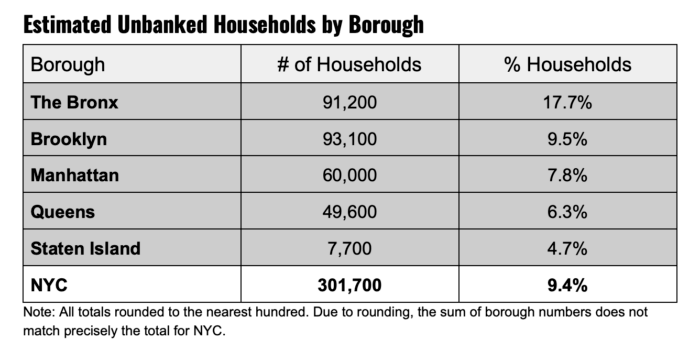

In 2021 the NYC Department of Consumer and Worker Protection (DCWP) announced a research brief, which revealed the updated number of unbanked households in NYC, detailing demographic information and highlighting systemic barriers to banking access. It shows that an estimated 301,700 NYC households — or around 3.6% of them — have no bank account, which is slightly lower than previous years, but still considerably higher than the national average of 5.4%. The findings included that 17.7% of Bronx households are unbanked, which is nearly two times higher than the rest of the city.

In the Bronx, seven banks closed 17 branches from 2018 to 2021 — more than half were in 2020 — reducing the total number of full-service branches to just 131, down from 144 in June 2018, according to The Association for Neighborhood & Housing Development. And more than 100 branches closed in 2020 in New York City, an increase from 74 closures in 2019 and 53 in 2018.

Without a full-service institution, bank-needy Bronxites rely on check cashers, pawn shops or branches of the largest national banks that typically charge high monthly maintenance fees for customers without direct deposit or certain minimum balances, multiple credit unions and Bronx residents told the Bronx Times.

One check cashing business that could be hit hard if this proposed regulation is approved is RiteCheck, which has 13 locations in the Bronx and Harlem. Doris Rosario, who has been a customer of the RiteCheck at 715 E. 138th St. for more than 30 years, was shocked when she heard the location could potentially shutter.

Rosario told the Bronx Times that the state must not understand how important check cashing facilities are. Having a place like RiteCheck is vital to residents because many are unbanked, Rosario said. She added that the closest banks for her are on 149th Street, so it would be a challenge for seniors or those with mobility issues to get there if RiteCheck was forced to close.

“The immigrants that come there (RiteCheck), they work,” she said. “This is where they go to cash their check. It’s really upsetting. I’ll keep it 100. They want to close these people down and I think it’s wrong. I ain’t only thinking about myself. I’m thinking about everybody else.”

Sheila Martinez, a human resources assistant for RiteCheck, said DFS does not realize the impact this proposed regulation will have on residents and check cashing employees. People will lose jobs, and many will need to find alternative places to bank, Martinez said.

Martinez said she and her colleagues were surprised the state wants to lower the fee rather than raise it, which would help businesses. She said RiteCheck is doing everything it legally can to fight the proposed regulation.

Lisa Sorin, president of the Bronx Chamber of Commerce, is also against the proposed regulation because “it could have unintended consequences.”

“You are hurting the businesses that have been there,” Sorin said. “I’m sure they (DFS) are doing this well–intended, but they’re not the ones in need of services.”

Reach Jason Cohen at jasoncohen306@gmail.com or (646) 899-8058. For more coverage, follow us on Twitter, Facebook and Instagram @bronxtimes