Even On Small Business Saturday, Neighborhood Businesses Are At Risk

It’s that time of year again, with late November bringing the start of the most lucrative time of year for many businesses of all sizes. In an effort to bring some of these economic windfalls to local communities and main streets, Small Business Saturday has become a national phenomenon.

New Data from ANHD Shows Citywide Challenges

It’s that time of year again, with late November bringing the start of the most lucrative time of year for many businesses of all sizes. In an effort to bring some of these economic windfalls to local communities and main streets, Small Business Saturday has become a national phenomenon. As New York’s small businesses face increased displacement pressures, it’s a good time to look at what small businesses mean for New York City’s economy and how this varies citywide.

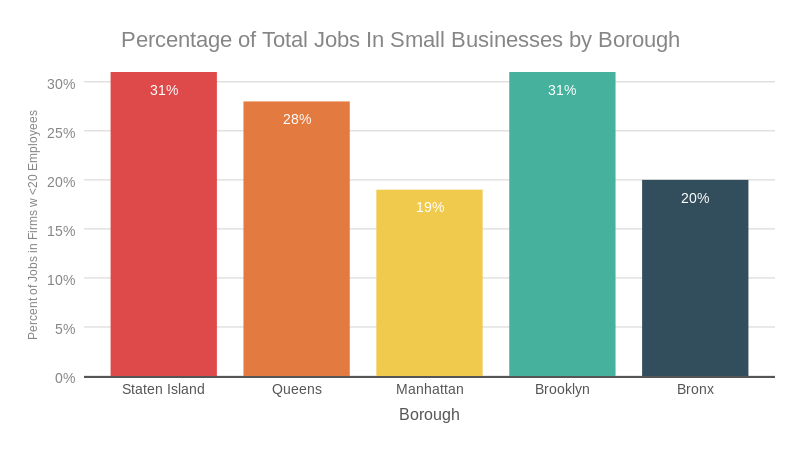

The Association for Neighborhood & Housing Development (ANHD) analyzed the economic vitality of small businesses across the city, neighborhood by neighborhood. For this analysis, ANHD defines small businesses as firms with 20 or fewer employees. According to US Census data, about 26% percent of all New York City jobs are in firms with 20 or fewer employees. The share of small businesses in a neighborhood varies widely.

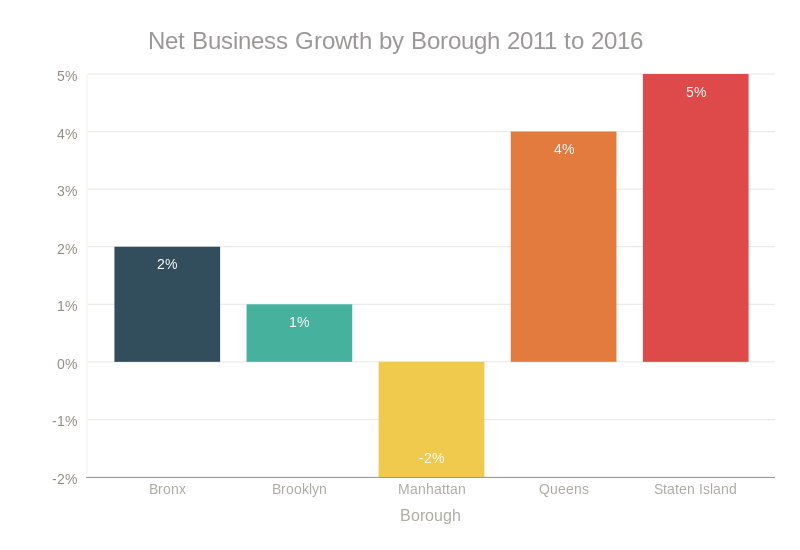

In addition to analyzing census data, ANHD used New York City Department of Consumer Affairs (DCA) license expiration data to track how many total businesses have expired licenses, in effect going permanently out of business, over the period of 2011 through 2016. This data excludes restaurants and grocery stores and does not make the distinction between a small business and a large one. However, it gives an idea of trends in economic growth by neighborhood.

Using the same DCA data, net percent change in businesses across the City was calculated, which takes into account new licenses, or new businesses that replaced permanently shuttered shops. Overall, New York City saw a 2% rise in total business creation over the past five years. This means that there were slightly more businesses in the City in 2016 than there were in 2011. While the outer boroughs all saw a net increase in businesses, Manhattan experienced a 2% net loss. Queens and Staten Island saw the most net growth, with a 4% and 5% rise in businesses overall, while total businesses in Brooklyn and the Bronx grew by 1% and 2%, respectively.

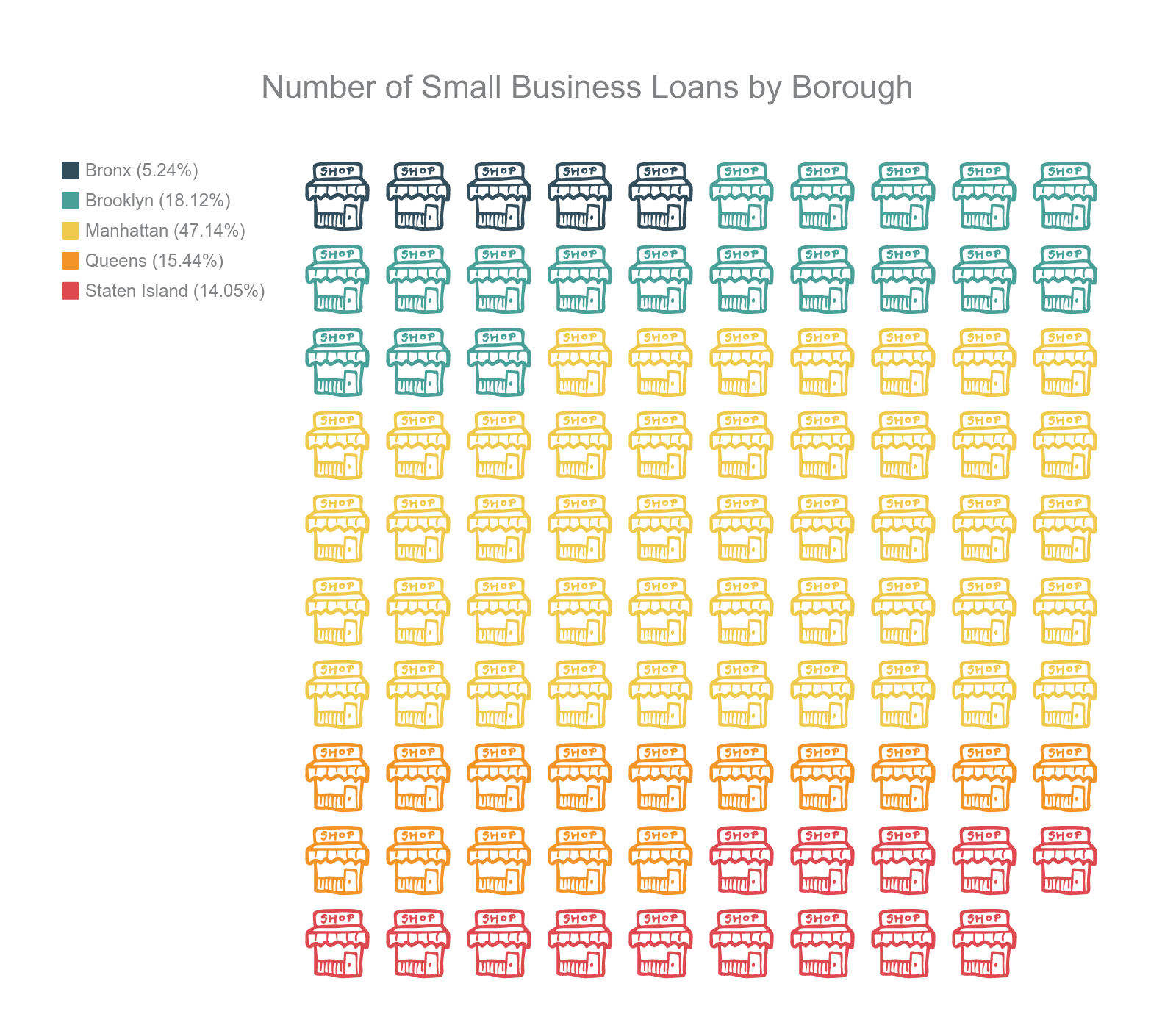

Despite net business growth in the outer boroughs, small business lending is deeply stratified. Almost half of all small business loans made in New York City were made in Manhattan. Brooklyn, Queens, and Staten Island received fairly comparable shares of loans at 18%, 15%, and 14% respectively. The Bronx, however, lagged much further behind, with Bronx businesses receiving only 5% of all the small business loans made in the City.

This is especially concerning since so many jobs in New York are within firms of 20 employees or less. 20% of jobs in the Bronx are at small businesses, while 19% of Manhattan jobs are at small firms. 28% of jobs in Queens and 31% of all Staten Island and Brooklyn jobs are located within firms with 20 employees or fewer. [pullquote]20% of jobs in the Bronx are at small businesses, while 19% of Manhattan jobs are at small firms. 28% of jobs in Queens and 31% of all Staten Island and Brooklyn jobs are located within firms with 20 employees or fewer.[/pullquote]

The lack of small business loans in these neighborhoods means a lack of small business jobs, which are sorely needed in communities with among the highest rates of unemployment in the city. Small business loans must be made accessible to all of New York’s communities- not just its wealthiest.

The displacement of neighborhood businesses not only threatens New York’s identity, but also eliminates jobs, community spaces, and affordable resources in low- and moderate-income communities of color. As the city’s long time small businesses are being replaced with vacant storefronts at an alarming rate, it is vital to implement robust protections to ensure their survival, and in turn ensure the vitality and vibrancy of New York’s neighborhoods. Stay tuned until next week for ANHD’s in-depth neighborhood by neighborhood analysis of the state of New York City’s small businesses, along with strategies to ensure their survival.