Housing Vacancy Survey Shows New York City Is in The Midst of An Affordability Emergency

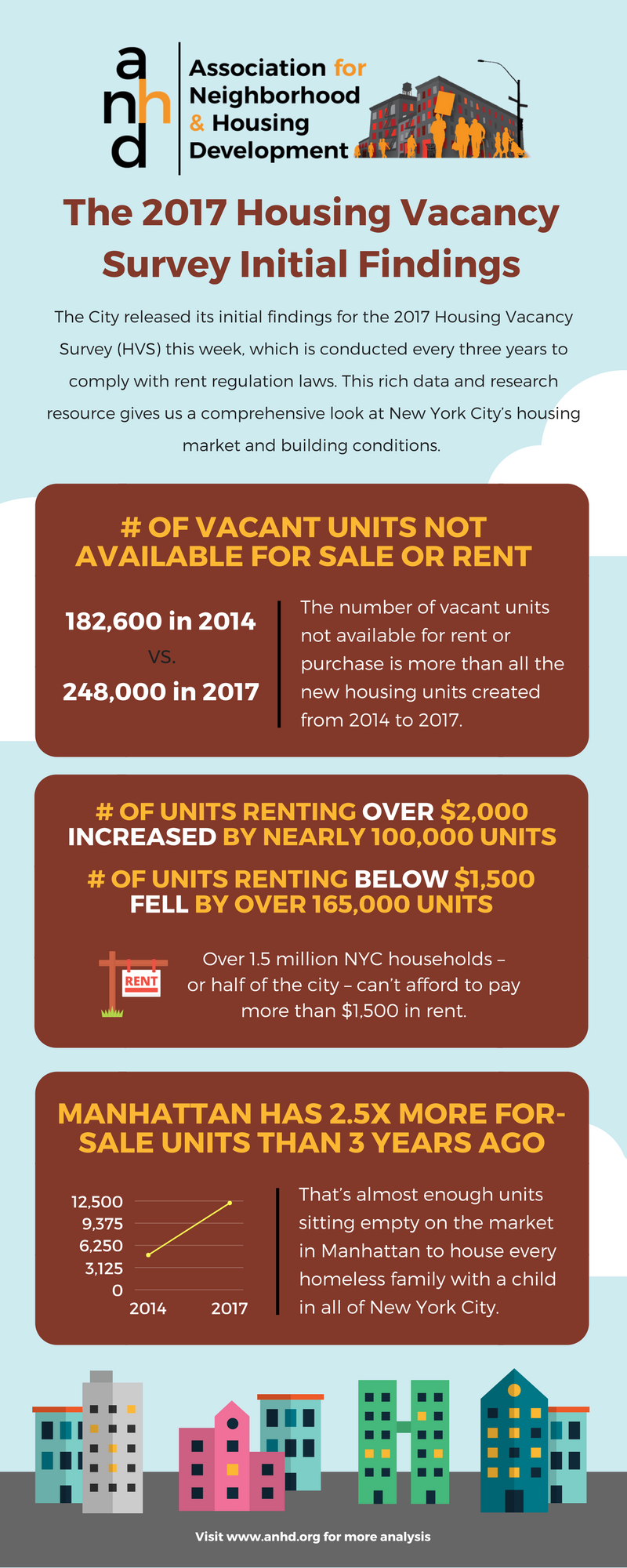

The City released its initial findings for the 2017 Housing Vacancy Survey (HVS) this week, which is conducted every three years to comply with rent regulation laws. This rich data and research resource gives us the only comprehensive look at New York City’s housing market and building conditions.

The City released its initial findings for the 2017 Housing Vacancy Survey (HVS) this week, which is conducted every three years to comply with rent regulation laws. This rich data and research resource gives us the only comprehensive look at New York City’s housing market and building conditions. We already knew New York City was in the midst of an affordability emergency, but the initial 2017 HVS findings raise serious new concerns about the direction of our housing market and affordability trends.

Despite the recent building boom, the share of rental units in the City fell from 64.2% in 2014 to 62.9% in 2017, and the share of homeownership units dropped during the same period. So, why have the share of rental units and homeownership units dropped? And what’s left? New York City saw a huge jump in the number of vacant units not available for sale or rent, from 182,600 in 2014 up to a whopping 248,000 in 2017. The number of vacant units not available for rent or purchase is more than all the new housing units created from 2014 to 2017. This jarring statistic begs the question, what’s all the new development really going towards?

It’s no surprise that the number of units with high rents is on the rise, and the number of units with low rents is declining. According to the HVS, the number of units renting for over $2,000 increased by nearly 100,000 units. Conversely, the number of units with a rent below $1,500 fell by over 165,000 units. All of this is happening while over 1.5 million New York City households – or half of the city – can’t afford to pay more than $1,500 in rent.

Additionally, the median asking rent jumped 33.9% from 2014 to 2017, which underscores our fight and our members’ fights against displacement. Tenants who lose their units – for whatever reason – can’t find a place to live without paying more, a lot more.

In comparison, the median rent for rent-regulated units – which is home for many of the City’s low- and moderate-income families – increased by 2.6%. On average, rent-regulated households earn $22,000 less a year than households that rent market-rate units. Holding on to an affordable rent-regulated unit has never been more critical to maintaining affordability for a household.

Meanwhile, Manhattan has 2.5 times more for-sale units sitting on the market than it did just 3 years. The number of owner-occupied units for sale in Manhattan jumped from 4,833 in 2014 up to 12,164 in 2017. That’s almost enough units sitting empty on the market in Manhattan to house every homeless family with a child in all of New York City.

The vacancy rate in Manhattan, the highest priced housing market of the five boroughs, rose to 4.73%. Meanwhile the Bronx, the City’s lowest priced housing market, had the lowest vacancy rate of just 2.71%. The lower priced units in the Bronx that are more affordable to New Yorkers are quickly sought and filled. Manhattan’s high housing prices mean much of their rental market is out of reach for most New Yorkers, leaving more vacant rental units sitting on the market unrented. This is a cautionary tale of what could come if the City’s overall housing prices continue to rise further out of reach for New Yorkers’ incomes. It’s clear that price matters when counting units; New Yorkers demand low-priced units, not luxury towers.

Over the next week, ANHD will be tweeting critical facts from the 2017 Housing Vacancy Survey’s initial findings. And look out for an in-depth look at New York City’s housing market and conditions later this year when the 2017 Housing Vacancy Survey data is released.