Just What Does the Albany 421a Plan Say?

On June 26, 2015 after a long campaign by the tenant and affordable housing movement both he Rent Laws and the 421a Developer Tax Break were renewed in Albany. The results, on both fronts, were not what the tenant movement had hoped despite running an excellent campaign to make 2015 the ‘Year of the Tenant.’

Just What Does the Albany 421a Plan Say? ANHD’s Preliminary Analysis on the Details

On June 26, 2015 after a long campaign by the tenant and affordable housing movement both he Rent Laws and the 421a Developer Tax Break were renewed in Albany. The results, on both fronts, were not what the tenant movement had hoped despite running an excellent campaign to make 2015 the ‘Year of the Tenant.’

There were numerous versions of 421a legislation introduced by different members in both the Assembly and the Senate. The final 421a plan heavily reflected Mayor de Blasio’s 421a proposal made public on May 7, 2015 and proposed as legislation in Albany as A.7945-2015 on June 1st.

Since the close of the 2015 session, housing advocates, policy experts, elected officials and the media have been digesting what exactly the new 421a legislation says, and what it will mean for New York City’s neighborhoods. Below is ANHD’s preliminary analysis on the details of 421a plan that come out of the June Albany session.

One of the biggest concerns of the tenant and housing movement, with regards to 421a was the depth of affordability required in comparison to the lucrative tax break to developers. ANHD members that represent neighborhoods throughout the city articulated that if 421a was not ended, their priority was to get the deepest level of affordability possible for 421a units. Under the enacted 421a legislation, many neighborhoods are likely to see rents in the 421a affordable units far too high for the incomes of local residents. Some neighborhoods are even poised to see 421a developments where affordable units’ rents are set at more than double what they were under the old 421a plan. Furthermore, the 421a plan extends the length of tax exemption to developers to 35 years, increasing the cost to the City in forgone tax revenues.

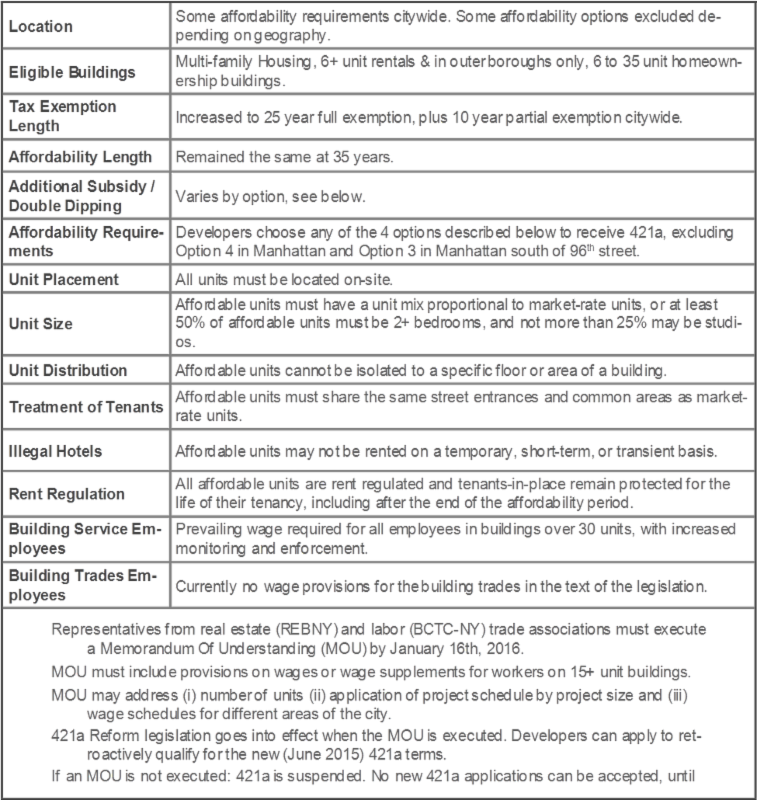

We begin by describing the details of what is in the legislation to help make clear, just exactly what the new 421a plan is:

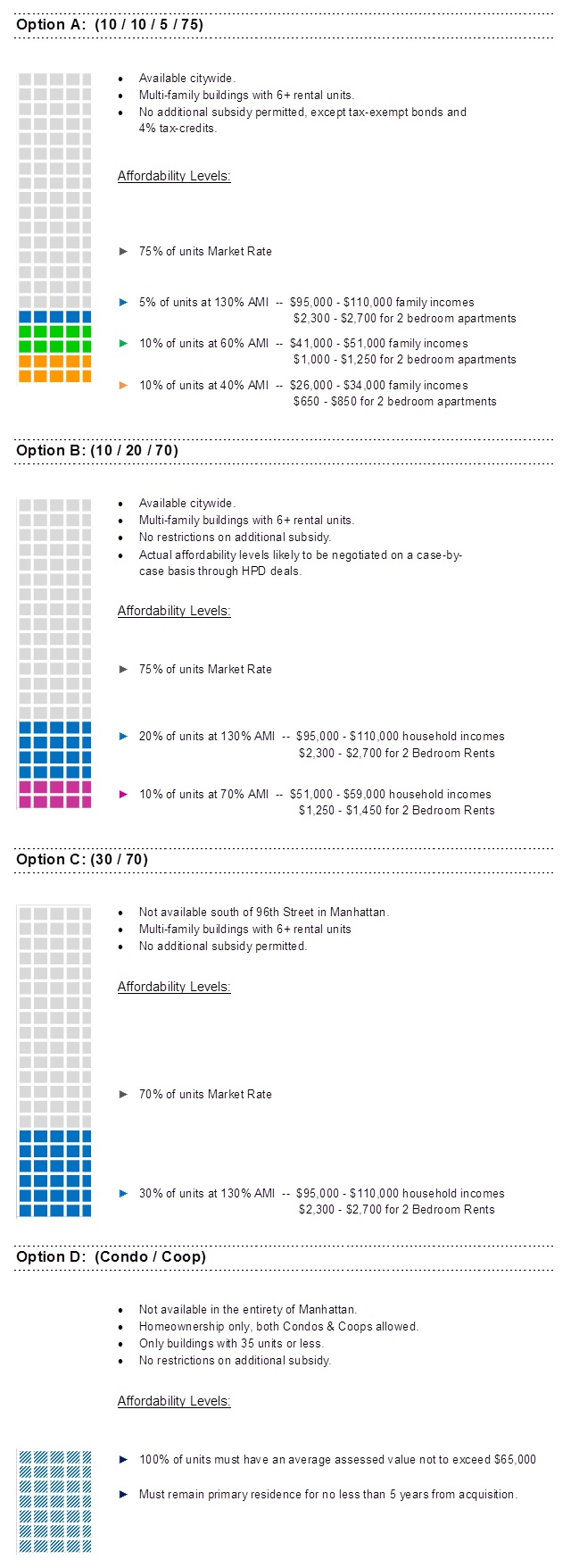

The 421a plan gives developers various options to meet their affordability requirements. There are four affordability options, Options A through Option D. Each option has a different set of affordability requirements, subsidy restrictions, geographic application, and building size requirements.

Each of these options is at the developer’s discretion. At the time of application to the 421a program a developer will indicate which of the four options requirements their given development is electing to fulfill. This decision must be made at the time of application and cannot be changed thereafter. It is important to note that which affordability requirement the building will use is solely the choice of the developer and requires no input or approval from any community boards, community groups, neighboring residents, or elected officials. As long as a development meets all the parameters of a given option they can choose that option ‘as of right’ and receive a 421a tax break.

The 421a Affordability Options available under the new legislation are:

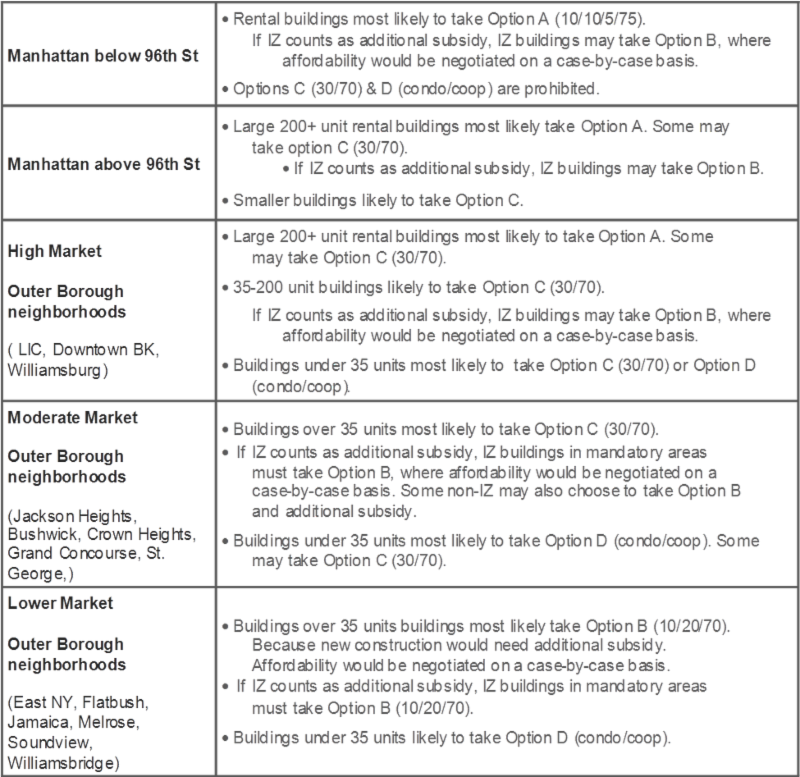

We still do not know what the new law and these affordability options will mean on a neighborhood-by-neighborhood basis. The administration designed their 421a proposal with the expectation that certain neighborhood real-estate markets would trend towards certain affordability options. And while the Administration never made their neighborhood market-typology projections public, the changes that Albany made to the Mayor’s 421a plan will impact their predications. The State’s enacted plan eliminated the proposed Mansion Tax, allows smaller 421a condo developments in the outer boroughs, and does not allow Option C to be taken in much of Manhattan.

ANHD has done some preliminary analysis to try to predict which of the enacted 421a options will be taken in which neighborhoods based on what would be most profitable to a developer given certain building sizes. This analysis assumes the current market conditions and is based on the current neighborhoods’ market rate rents and building stock. It cannot account for the possible implications and structural changes that might come out of the MOU negotiations between REBNY and the NY Building Trades Council, nor can it account for the likely options in neighborhoods after a rezoning.

Here is ANHD’s preliminary analysis of what the enacted 421a law means for your neighborhood:

the enacted 421a law means for your neighborhood:

Despite the close of the June 2015 Albany session and enacted legislative text, there are still key questions that remain unanswered. There are a number of items that have not been resolved or clarified that will have significant impacts on both the utilization of 421a by developers, the impact on tenants, and the impact on neighborhoods.

Real Estate & Labor’s MOU

- What could / will a REBNY & BCTC-NY MOU agreement look like?

- How will the MOU address construction wages, given the restriction of not modifying the 421a reform deal’s terms?

- Is the MOU only applicable to members of the two signing entities? Or can be applied more broadly?

- How will the MOU it be enforced? Especially as it applies to developers who are not REBNY members?

- What is the recourse if either party violates the MOU?

Affordability Levels

- What share of developers will take Option A, Option B, Option C, or Option D?

- What does this mean for overall depth of affordable units for the City?

- Will the 130% AMI units be priced at or above markets in some neighborhoods?

- Will the 130% AMI option add affordable units; or further gentrification, displacement, and neighborhood destabilization?

Location

- Where will developers take which 421a options?

- How will that change over time as markets change?

- How will this impact the supply and type of affordable units available in neighborhoods?

- Are there areas that might now trend or be driven more towards homeownership Option D?

Subsidy / Double Dipping

- Does either voluntary or mandatory inclusionary zoning count as ‘double-dipping’ i.e. is considered subsidy in the 421a legislation?

- Restricted subsidy is defined in the text as “Substantial assistance of grants, loans or subsidies provided by a Federal, State or Local governmental agency or instrumentality pursuant to a program for the development of affordable housing.”

Tax Exemption Length

- How much will the increased 35-year exemption length cost the City in lost tax revenues over the long-term?

- Specifically what is added cost for increasing the exemption length to 35 years?

- The IBO recently cost projections for the 2015 enacted legislation that estimated cost to the city of $3.3 billion dollars in forgone tax revenue, but these estimates are for over the next 10 years.

Tenants’ Rights

- How will tenants’ rights be protected?

- How will the City ensure tenants are provided with leases that clearly explain their rights, the affordability length, and the regulations for each unit and for the building?

Rent Regulation

- How will higher AMIs impact the long-term preservation of 421a units?

- Especially given the decontrol threshold? Rents for 2+ bedroom units at the 130% AMI level could end up being set at or above the decontrol threshold.

- What are the implications of market-rate units no longer being covered by rent-regulation?

City Council’s Role

- What might the City Council do with Albany’s 421a reforms?

- City Council is empowered to “restrict, limit or condition the eligibility, scope, or amount of 421a benefits.”

- Any City Council changes go into effect in June 2016.

- Will the City Council impose a more restrictive 421a?

It will be months before some of these questions are resolved. While other answers we might not get until developers begin using 421a under the new rules and we see how that process and decision unfold. And some await answers on pending questions to Administration or legal experts.

There is still much to be understood, analyzed, and settled about the new 421a plan. There is still much we do not know; what we do know is that 421a will play significant role in fueling the NYC development market, in impact the City in the way of forgone tax-revenue, and in the level of affordability available in neighborhoods.

for recent press on ANHD’s stand on key community development issues.