NYS 421a Plan: More $ for Developers … Again

In the final days of this session, Albany elected, City officials, Real Estate and Labor continue to debate an agreement on the 421a developer tax exemption, which sunset earlier this year. Last night, at 11:58 PM, new 421a legislation was introduced in the Senate which gives away more to Real Estate, requires less affordability, and leaves tax payers footing an even bigger bill.

- Repeals the authority of New York City government to shape the affordability requirements of 421a. This role for City has been an important counter-balance to the worst abuses of the program in previous years, and the loss of the City Council’s role weakens a crucial local voice to reform the exemption.

- Decreases the percentage of affordable units required, while keeping affordability levels too high for many New Yorkers to actually afford. Decreases the affordability requirement for homeownership, raising the average assessed value to $75,000 per unit and reduces the percentage of units that have to be below the average cap from 100% to 50%.

- Expands the number and type of buildings eligible for the “extended affordability period” by allowing buildings currently receiving 15-year abatements to apply to extend a partial exemption for another 15 years. Extending the abatement on existing buildings that have no affordability is inefficient and has no policy justification and is a pure real estate industry dip into the taxpayers’ pocket.

- Keeps in place the Mayor’s proposed increase of the exemption length to 35 years, which will dramatically increase the cost the City in lost tax revenues.

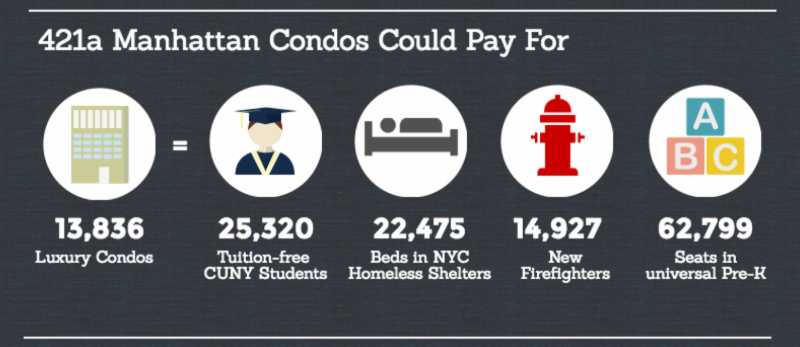

Encouraging the development of large amounts of market-rate housing increases displacement pressure on the surrounding affordable housing stock. Furthermore, in many neighborhoods where on its own the market is weak enough to encourage developers to make use of the city’s programs to develop 100% affordable housing, 421a can tip the scales towards encouraging market rate development instead. So the local impact of incentivizing development under 421a, even where affordable units are required, may be a net loss of affordable housing in a neighborhood. 421a is New York City’s most expensive housing program. As an affordable housing program, it is highly inefficient. We will already give away $78.7 million dollars a year to new condos built since 2010, that would have almost certainly been built anyway and are not necessary to build these luxury units. We cannot afford to continue spending precious public resources to enrich developers. As Albany legislators head into the final days of negotiations, they must keep the true housing priorities of last June’s legislative session. We must strengthen Rent Regulation, prevent illegal hotels, fund NYCHA, agree to an MOU to balance housing spending needs, and improve State affordable housing programs to meet NYC’s deep affordability needs. Blogger: Barika Williams, Deputy Director, ANHD