About the Report

Amid growing conversations about potential financial distress among rent stabilized buildings, this report brings together historical context and new research on ownership of rent stabilized buildings. Building a clear understanding of current concerns about the sustainability of rent stabilized buildings, the history of deregulation and predatory equity, and current ownership patterns, we highlight the crucial ongoing importance of 2019’s Housing Stability and Tenant Protection Act, demonstrate that concerns about bad actors are well founded, and debunk the misguided narrative that the challenges within rent stabilized housing are the same as those facing subsidized housing.

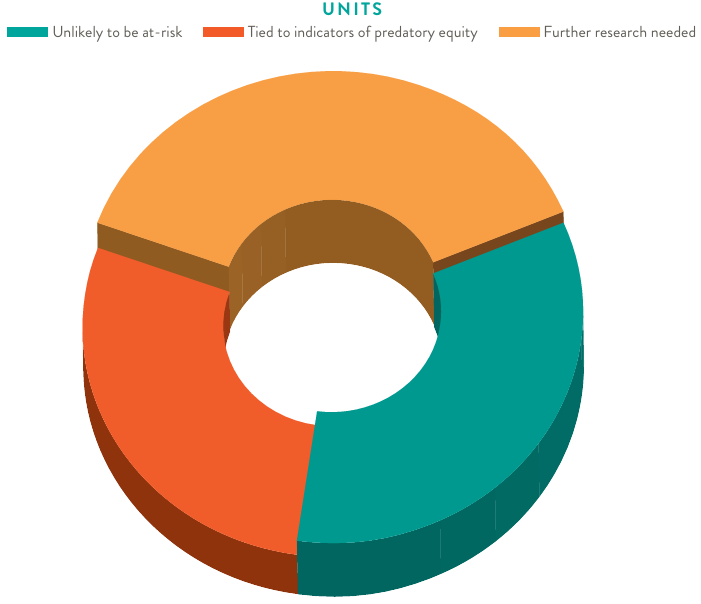

Using data on rent stabilized unit counts provided by the nonprofit JustFix, our analysis focuses on the subset of rent stabilized properties most often described as at risk of financial distress – those that are older (built before 1974), highly stabilized (at least 75% of units are rent stabilized), and not tax-exempt. Within this subset, we find that over a third of properties, and nearly half of apartments, are linked to one or more indicators of predatory equity and irresponsible ownership. Past speculative purchases remain present today.

The vast majority of rent stabilized units are either in buildings that are unlikely to be at-risk of financial distress, or are in buildings that are tied to predatory equity.

Why This Matters

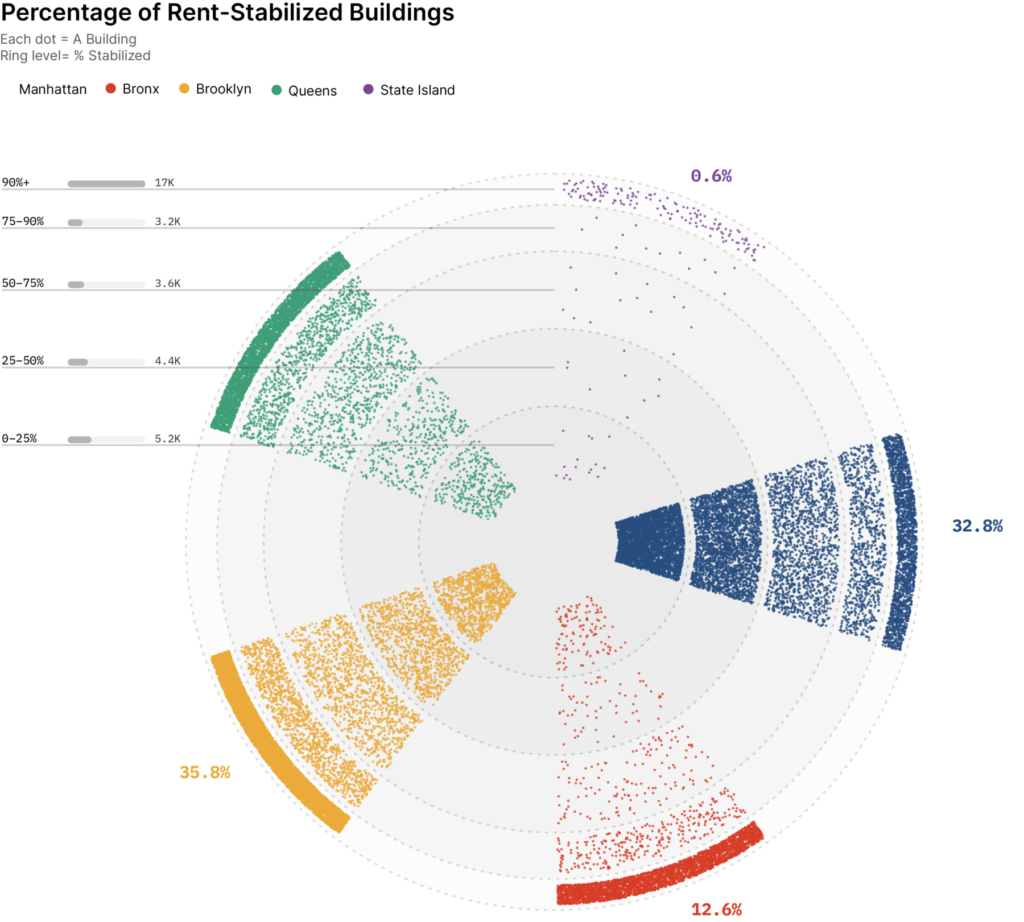

For tenants across the city, the health of the stabilized stock has profound implications. Rent stabilized units are fairly evenly distributed across the boroughs, aside from Staten Island: Brooklyn, Manhattan, and the Bronx each have over 250,000 stabilized apartments, and there are nearly 180,000 in Queens. In total, they account for more than 40% of all rental homes, and with average rents about 25% lower than market rate, they are a core piece of New York City’s supply of affordable housing.

To view an interactive version of this chart, click here.

Though conversations about financial distress in rent stabilized housing have grown over the past year, the picture of distress in rent stabilized housing has remained murky. While many stabilized apartment buildings appear to be financially stable and profitable, recent data indicates that a subset of them may be facing challenges. As our research shows, this same subset of the stabilized stock is rife with indicators of predatory equity and irresponsible ownership. Any approach that seeks to address financial distress in rent stabilized buildings must be deliberate to separate out and support responsible landlords rather than irresponsible ones.

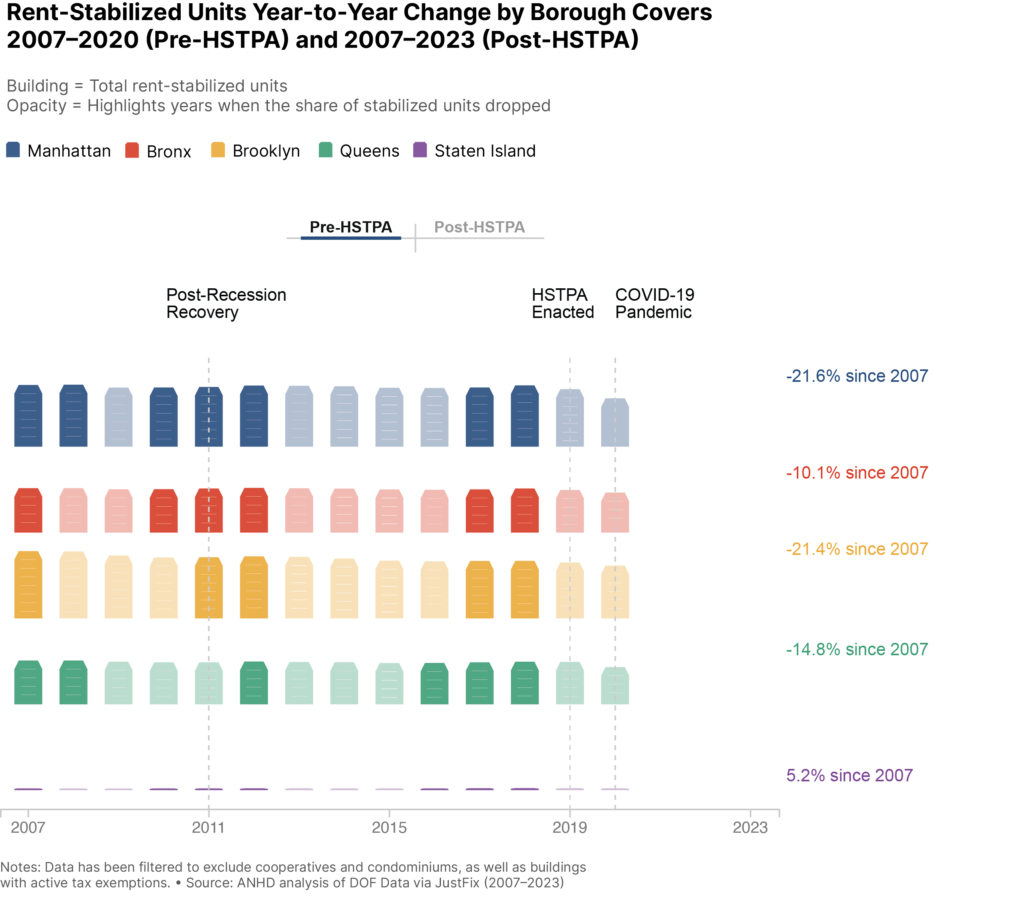

The stakes are high. During the 25 years preceding the Housing Stability and Tenant Protection Act (HSTPA) of 2019, New York lost more than 300,000 stabilized apartments to deregulation — and the landlord lobby wants to re-open the loopholes that allowed this to happen. They have attempted to cast HSTPA, rather than predatory equity overleveraging, as the root cause of financial distress in highly stabilized buildings. This is revisionist history at its most dangerous, and we must reject it. We cannot afford to return to a pre-HSTPA world where harassment was far too commonplace and where rent stabilized tenants lived in the shadow of loophole-based rent hikes and deregulation, and we can’t afford to buy into this false narrative and make the mistake of bailing out the bad actors that perpetuated these cycles of displacement with precious public dollars. Instead of allowing landlords to undermine tenants’ rights, we need to develop a nuanced perspective on potential financial distress.

Click here for an interactive version of this chart.

What We’re Doing

ANHD is working with our member organizations and allies to defend rent stabilization and to ANHD will advocate at the state and local level to advocate for common-sense reforms, like those included in the report, to ensure that bad actors are accountable to the public, and to ensure that policy solutions and funding focus first and foremost on resolving the crisis facing our subsidized housing

Click the “Download” button at the top of this page to read the full report.