ANHD EqED Chart Looks at How Small Businesses Are Threatened Across the City

The holiday season is upon us, which means the start of the most lucrative time of year for many businesses of all sizes. In an effort to bring some of these economic windfalls to local communities and main streets, Small Business Saturday has become a national phenomenon. As New Yorkers get ready to open their wallets for the holiday spending season, it’s a good time to look at what Small Businesses mean for NYC’s economy and how this varies by neighborhoods.

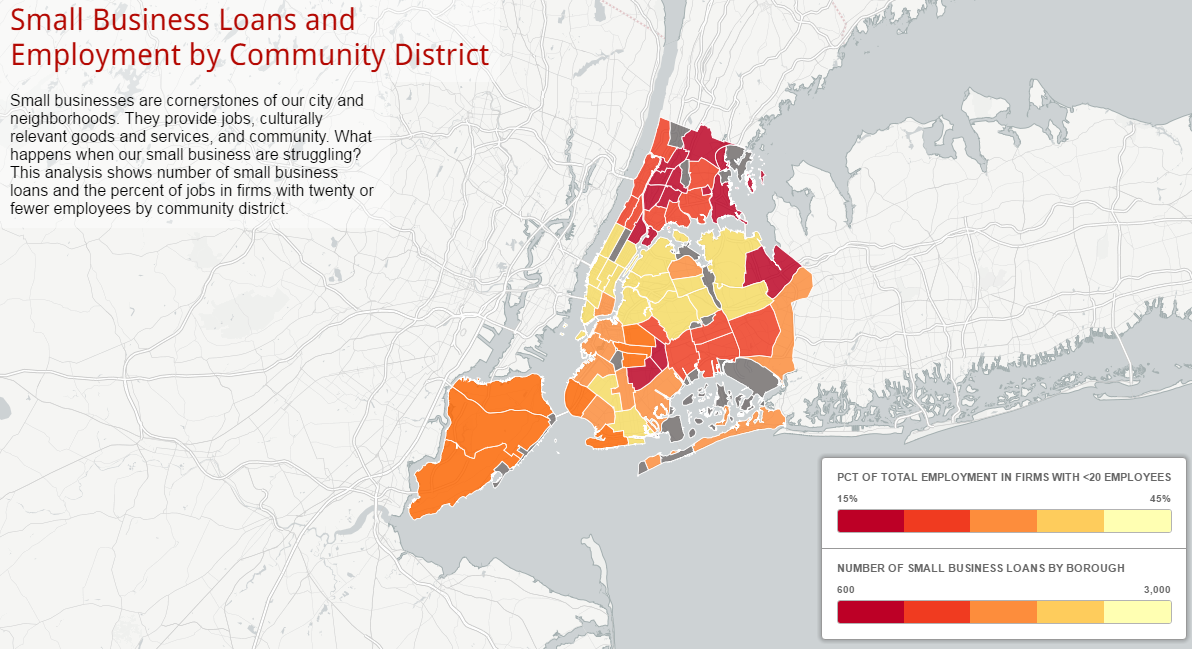

As part of How is Economic Opportunity Threatened in Your Neighborhood?, ANHD analyzed the share of people employed by small businesses and the number of small business loans made available in 2015 across all of New York City’s neighborhoods. For this analysis, ANHD defines small businesses as firms with 20 or fewer employees. According to US Census data, about 20% percent of all NYC jobs are in firms with 20 or fewer employees. The share of small businesses in a neighborhood varies widely. Neighborhoods like Crown Heights, Bay Ridge, Bayside, and Great Kills all have over 40 percent of their local employment in firms with less than 20 employees, the highest rates in the City; whereas, the Financial District, Midtown, East Harlem, and Kingsbridge all had the City’s lowest rate of employment in small businesses, below 13 percent. It is important to note that this data relies on local, state, and federal administrative sources and will likely not capture any unregistered or undocumented businesses of employees that are more prevalent in immigrant and low-income communities.

However, the neighborhoods with large concentrations of small businesses do not always see the greatest investment of capital; and as ANHD’s analysis shows, many neighborhoods are left out of the picture.

The number of small business loans in a neighborhood indicates where economic investment is concentrated in the City. Additionally, the lack of loans in pockets of the City can show where small business owners do not have adequate credit to access the resources necessary to start and run a successful business.

Check out our interactive map where you can see the percentage of total employment in firms with less than 20 employees and the number of small business loans by borough.

An analysis of citywide small businesses and small business loan data revealed that:

On average, 5,359 small business loans were made across New York City by borough in 2015.

While Manhattan led in number of loans, at an average of 9,840 borough-wide, there was a sharp discrepancy in loan access between upper Manhattan and the rest of the borough, with the exception of the Lower East Side/Chinatown.

Harlem, Morningside Heights, and the Lower East Side/Chinatown received much fewer loans than the rest of the borough, with Chelsea receiving 25 times as many small business loans as East Harlem.

Despite the lack of access to loans, Central Harlem and the Lower East Side/Chinatown heavily depend on small firms. 28% of all jobs in Central Harlem and 36% of all jobs in the Lower East Side/Chinatown exist within small businesses.

Queens followed after Manhattan, with an average of 9,140 loans. However, these loans were highly concentrated in neighborhoods such as Astoria, Long Island City, and Forest Hills. After Manhattan, Queens has the sharpest rate of inequity in terms of small business loans, with certain neighborhoods such as Ozone Park and Woodhaven receiving among the lowest number of loans in the city.

Approximately 20% of all employment in Queens is in firms with 20 or fewer employees.

Brooklyn and Staten Island received an average of 3,700 and 2,930 loans respectively, though 31% of Brooklyn’s total employment is within small businesses.

The Bronx received by far the lowest number of loans, with an average of 1,095 loans borough-wide, and the University Heights/Fordham area received the lowest number of loans citywide at just 659. However, 21% of employment in the Bronx depends on small businesses. The Bronx also has the highest rate of unemployment in the city. If small businesses cannot receive access to the resources they need to thrive, job opportunities across the borough will continue to dwindle.

Conclusion

Small businesses are cornerstones of our city and neighborhoods. They provide jobs, culturally relevant goods and services, and community, keeping our neighborhoods thriving and vibrant places to live. In a climate where small businesses routinely face displacement, advocates, business owners, and community residents are challenging policy makers to come up with a vision for effective policies and programs that support and protect our City’s small businesses.

Strategies to support and strengthen small businesses across the City must be broad and inclusive in order to address the multitude of issues faced by small businesses, from lack of access to credit to gentrification to tenant harassment to red tape. Financing tools and credit building resources should be made available to the City’s small business owners along with policies that help small business owners stay in the communities and neighborhoods that need them.