Introduction

An obscure provision called the Individual Apartment Increase (IAI) has become one of the most contentious battlegrounds in the legislative struggle currently taking place between tenants and landlords in Albany. This loophole, like many others, was enacted in 1994 when a Republican-controlled New York State Senate forced the Democratic-controlled New York State Assembly to pass major weakening provisions in the rent regulation system. As a result of those changes, recent data shows that thousands of rent stabilized apartments have been taken out of the system each year, contributing to a 77% increase in the number of New York City residents in homeless shelters over the past ten years. By 2016, 72.8% of low- and moderate-income households were considered rent burdened. Since control of the New York State Senate shifted to Democrats in 2018, tenants and their allies in Albany are expecting to implement major changes in the 2019 legislative year to close the loopholes and expand much needed renter protections.

The Individual Apartment Improvement (IAI) rent increase loophole is an under-examined mechanism that allows landlords to collect a significant, permanent rent increase on a vacant apartment in return for making physical improvements to that apartment. The landlord lobby argues that the IAI system is an appropriate way of improving the quality of the housing stock by encouraging landlords to make modest physical improvements on vacant units before they are rented out again. But a review of available data shows the IAI system to be not only open to rampant fraud, but fundamentally designed and legally used to drive speculation and displacement.

How Do IAIs Work?

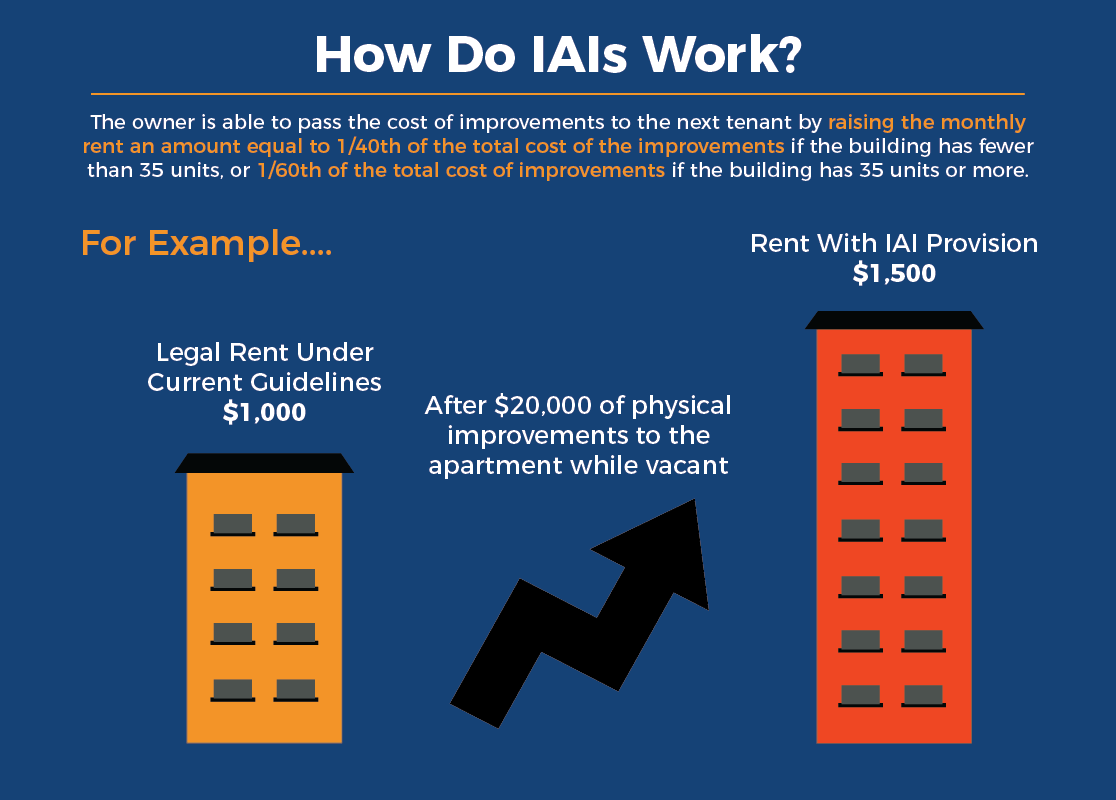

The IAI provision allows a landlord to raise the rent on an unoccupied rent regulated apartment by making physical improvements to the apartment. The owner is able to pass the cost of improvements to the next tenant by raising the monthly rent an amount equal to 1/40th of the total cost of the improvements if the building has fewer than 35 units, or 1/60th of the total cost of improvements if the building has 35 units or more. For example, if a new tenant moves into an apartment in a 30-unit building where the legal apartment rent should have been set at $1,000 a month under current guidelines, but the landlord spent $20,000 on physical improvements to the apartment while it was vacant, then the monthly rent can be set at $1,500 (1/40th of $20,000 is $500). This formula allows for dramatic rent increases.

What Do We Know About the Impacts of IAIs?

There is no comprehensive data about the actual scope and scale of IAI’s impacts, in large part because no agency tracks them. The system relies wholly on user self-certification and does not require landlords to proactively request permission for an increase from the New York State agency for Homes and Community Renewal (HCR), or even submit proof after the fact of the expenses on which an IAI is based. And because the work is performed in vacant apartments, the new tenant is in no position to know if their new rent is legally justified.

How Does the IAI System Fuel Speculation?

New York is a city of renters with 2.1 million rental apartments. Many of those apartments – 1.4 million – are rent regulated. The rent regulation system is designed to give tenants some stability in a real estate market so tight that, without rent regulation, the interests of tenants and landlords would be extraordinarily unbalanced. The fundamental logic of rent regulation is that the free market cannot reasonably balance the interests of landlords and tenants if the apartment vacancy rate is exceptionally low; if an apartment badly needs repairs or if a landlord is withholding basic services, the tenant would need to think long and hard before leaving because the vacancy rate for moderately-priced apartments is minuscule. For this reason, the rent regulation laws only exist if the vacancy rate is below 5%, and regularly sunsetted only reestablished by the state legislature when the low vacancy rate is reconfirmed.

What Does IAI Fraud Look Like?

Previous reports have pointed out why the IAI system is encouraging of landlord fraud. A class action lawsuit generated in 2017 by HRI against Stellar Management shows how IAI fraud works. The lawsuit quotes a separate lawsuit filed against the founder of Stellar Management, Laurence Gluck, by a partner for inflating IAI-related improvements and paints a clear picture:

Conclusion

Legislation to repeal the IAI loophole has been introduced by the Chair of the Senate Committee on Housing. And indeed, eliminating IAIs is an important step towards restoring the function and purpose of the rent regulation system as a whole. Beyond clear evidence of fraud and abuse, even legal IAIs are not being used to encourage basic investment and maintenance, but to enact extreme rent increases between tenancies. And the fact that such a loophole exists in the system encourages the very speculation rent regulation is designed to prevent.

Physical improvements eligible under the rules can include, for example, new bathroom fixtures, new kitchen appliances, and new flooring. Costs associated with maintenance, such as plumbing, sanding floors, and painting are not considered to be improvements and cannot be counted towards an IAI increase. An IAI rent increase can be taken in addition to any other rent increase to which the landlord is statutorily entitled.

Physical improvements eligible under the rules can include, for example, new bathroom fixtures, new kitchen appliances, and new flooring. Costs associated with maintenance, such as plumbing, sanding floors, and painting are not considered to be improvements and cannot be counted towards an IAI increase. An IAI rent increase can be taken in addition to any other rent increase to which the landlord is statutorily entitled. While it is troubling that there may be fraud in a significant percentage of IAI cases, recent data from the housing watchdog group Housing Rights Initiative (HRI) points to an even more fundamental problem with the IAI system.

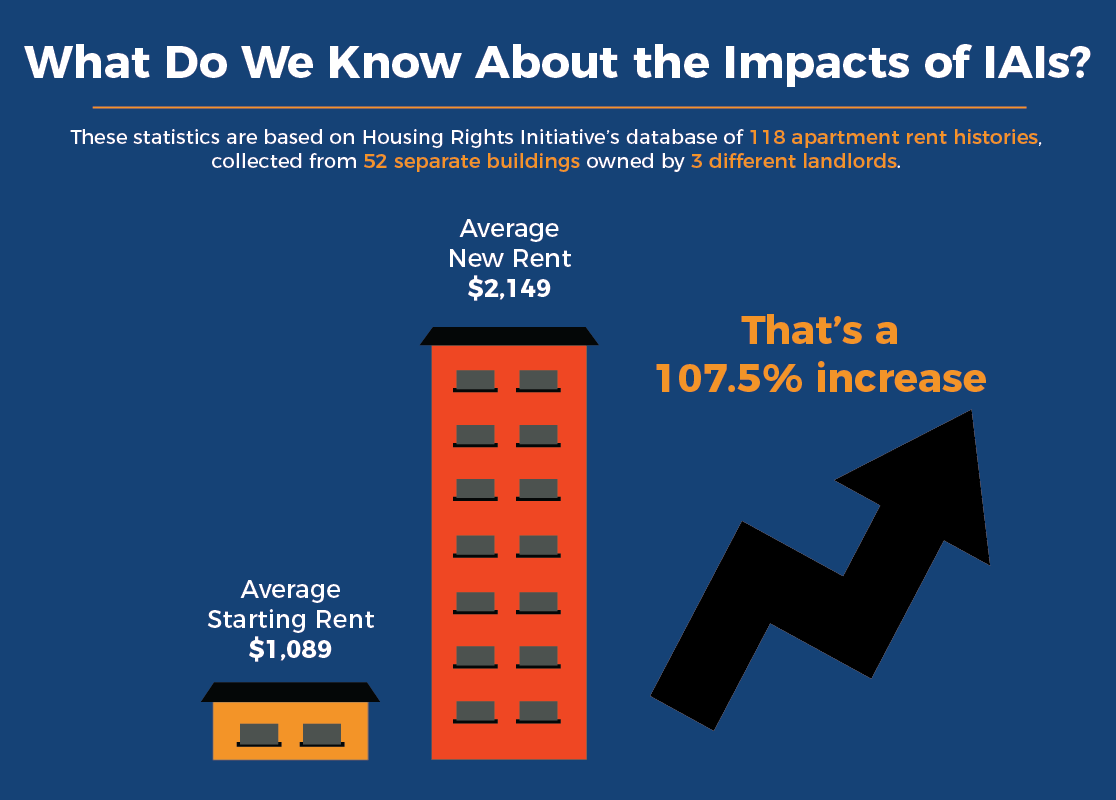

While it is troubling that there may be fraud in a significant percentage of IAI cases, recent data from the housing watchdog group Housing Rights Initiative (HRI) points to an even more fundamental problem with the IAI system.