The Association for Neighborhood and Housing Development (ANHD) thanks Chair Nestor Davidson and members of the Rent Guidelines Board for the opportunity to submit testimony regarding rent guidelines for rent stabilized housing for 2024-2025 leases.

About the Association for Neighborhood and Housing Development (ANHD)

ANHD is one of the City’s leading policy, advocacy, technical assistance, and capacity-building organizations. We maintain a membership of 80+ neighborhood-based and city-wide nonprofit organizations that have affordable housing and/or equitable economic development as a central component of their mission. We bridge the power and impact of our member groups to build community power and ensure the right to affordable housing and thriving, equitable neighborhoods for all New Yorkers. We value justice, equity and opportunity, and we believe in the importance of movement building that centers marginalized communities in our work. We believe housing justice is economic justice is racial justice.

ANHD was founded in 1974 by eight community development corporations who fought back against New York City’s fiscal crisis and disinvestment from Black and Brown neighborhoods by taking over distressed housing and investing in its operations and maintenance so that low-income New Yorkers could stay in their neighborhoods. Today, ANHD’s non-profit members have built over 123,000 units of affordable housing in our city’s most distressed neighborhoods.

Rent stabilized tenants remain in dire economic conditions and cannot afford rent increases.

New York City tenants remain in an unprecedented era of precarity and housing instability. In New York State, 16% of renter households are behind on rent – an estimated 450,000 households in total.[1]

The 2023 Housing and Vacancy Survey paints a grim picture for New York City tenants overall:

-

18% of households making less than $50,000 per year and 13% of all households missed their rent payment at least once in the previous year.[2]

-

86% of households making under $25,000 per year and 45% of households making between $25,000 and $50,000 per year are severely rent-burdened, paying over half of their income toward rent.[3]

As a group, rent stabilized tenants have significantly more difficulty affording their current rent than tenants of market-rate housing:

-

The median household income of rent stabilized tenants in 2023 was 34% lower than that of market-rate tenants: $60,000 versus $90,800.[4]

-

Rent stabilized tenants are 50% more likely than market-rate tenants to be food insecure and twice as likely to be very food insecure.[5]

Landlords have filed over 223,006 total nonpayment cases against New York City tenants since pandemic eviction protections expired on January 15, 2022. They have filed over 7,000 non-payment evictions against tenant households every month since March of that year.[6] Since those protections expired, there have been 18,303 residential evictions by court-ordered marshals.[7] That figure does not include the many tenants who self-evict before a court case reaches the point of a marshal warrant being executed.

Because rent stabilized units constitute 41% of the rental housing stock,[8] we estimate that at least 91,000 of the eviction cases filed since January 15, 2022 and 7,504 of the marshal-executed evictions were in rent stabilized housing. This likely represents an undercount, as rent stabilized tenants generally face more economic hardship (as the Income and Affordability study mentions, approximately 58% of eviction cases are in regulated housing).[9]

The continuing scale of nonpayment eviction filings demonstrates the dire economic circumstances of many tenants at their current rents; as noted above, between 13-16% of tenants are regularly falling behind on rent. Raising rents will only make this problem worse, bring more households into an impossible level of rent burden, and lead more to fall behind on rent. ANHD and others in the housing movement are working on myriad alternative solutions to this problem, and raising rents on tenants who are on the brink of losing their housing is not the right one.

Recent rollbacks to HSTPA mean that when landlords push current tenants out, stabilized rents are already set to increase significantly. The State housing budget that passed last week includes increases on the amount that can be recovered from Individual Apartment Improvements from $15,000 to $30,000 or $50,000. These higher caps will increase monthly rents anywhere from $178 to $347 per month. Additionally, these increases will now be permanent, rather than time-limited; this means that landlords can profit off of renovations – which are generally cosmetic – indefinitely.

For tenants who get pushed out due to high rent and a lack of ability to pay, there is nowhere to go. When landlords raise the rent, tenants cannot find another apartment at a lower price. While vacancy is low across the board, it is by far lowest at the bottom and middle of the rental market. There is less than 1% vacancy in rent stabilized housing and in housing that rents for less than $2,400/month.[10] This means that for tenants who cannot afford their rent, they most often end up doubled-up in overcrowded housing or become homeless. What some would consider minor rent increases are not at all minor when so many tenants cannot afford their current rent.

Source: ANHD, Data brief: we have the least housing where renters need it most

There are almost no affordable apartments available. While 703,628 rent-burdened households would need units renting for less than $1,100/month in order to no longer be rent-burdened, only 2,297 such units are available. There are only 5,309 available units renting between $1,100 and $1,649 per month and 4,358 units renting between $1,650-$2,399.[11] The lack of available, low-rent housing is frightening. RGB increases to stabilized rents would exacerbate the problem further.

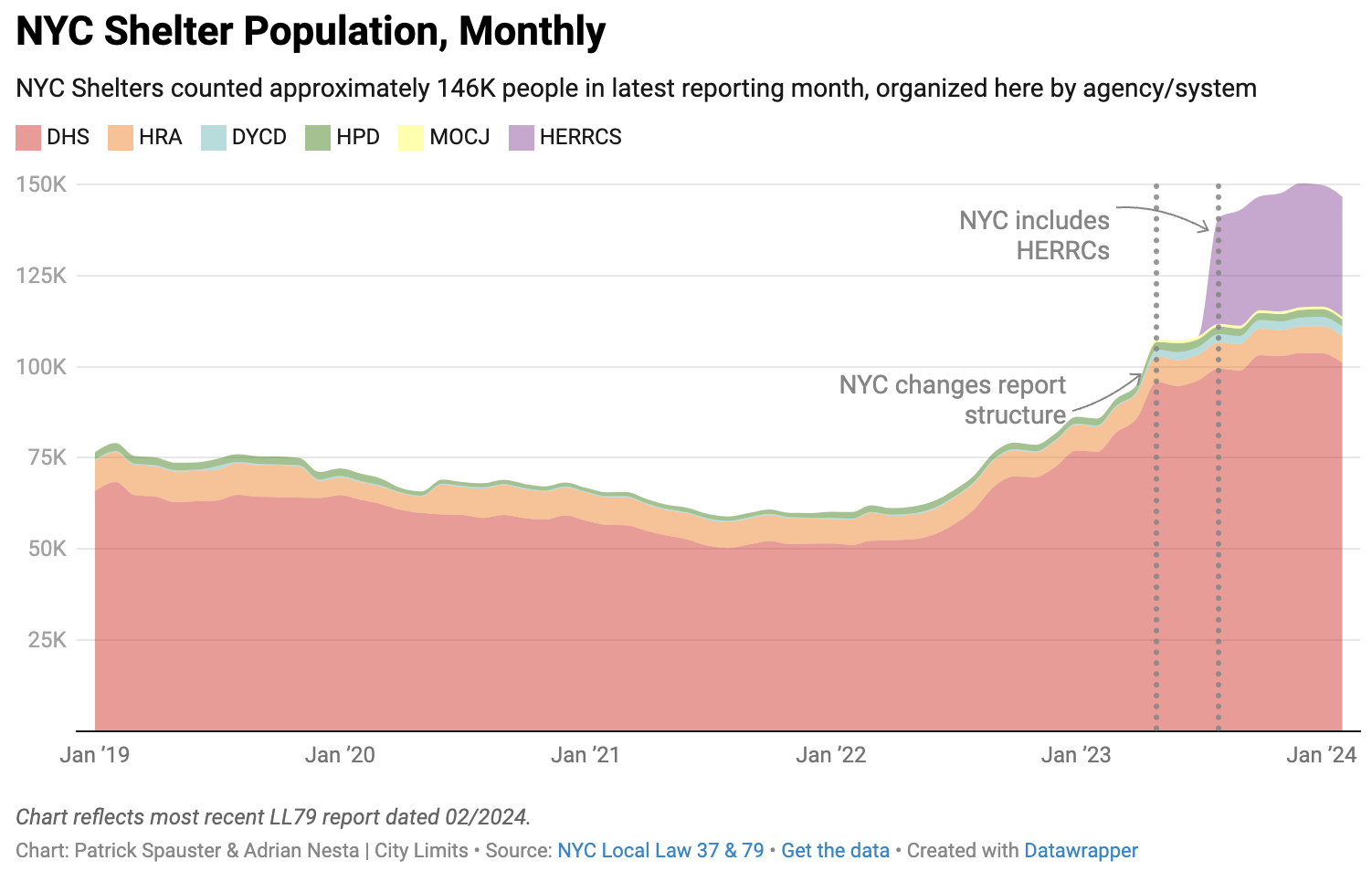

Homelessness numbers continue to skyrocket. At the beginning of 2022, there were 60,170 individuals in New York City homeless shelters. At the beginning of 2024, there were 149,849.[12] New York City cannot sustain increasing homelessness; we must take all possible measures to stabilize housing for those who are currently housed. Increasing rents for rent stabilized tenants will add to the numbers of New Yorkers in shelters, creating increased strain on our social services, increased government spending, and worsening conditions for those who are already homeless.

Source: City Limits, NYC Shelter Count

It is abundantly clear that tenants are in crisis. Rent stabilized tenants who are lower-income than private unregulated tenants face even more dire circumstances, with less ability to cover even minor cost increases. Rent increases will lead to more tenants who can’t afford their rent and will fall behind on payments and face eviction and homelessness. We urge the Board to acknowledge that rent increases will translate to more New Yorkers in shelters and on the street.

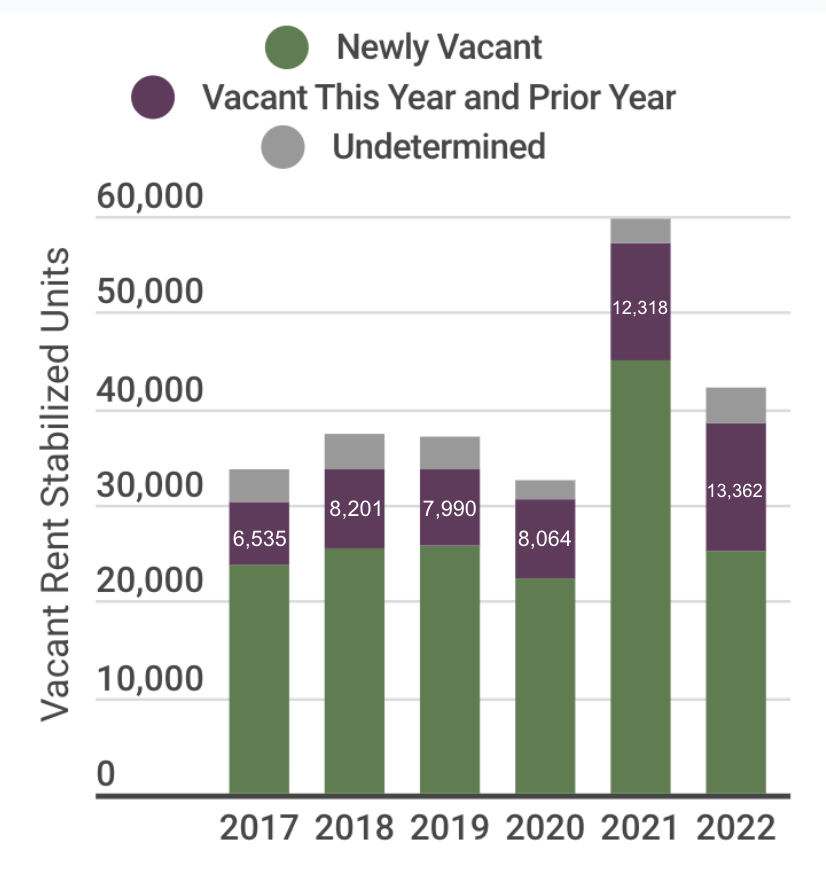

While landlord groups claim that low rents mean they are holding units vacant, the problem has been grossly overstated. Since the passage of the Housing Stability and Tenant Protection Act (HSTPA) of 2019, landlord interest groups have claimed that a lack of vacancy bonuses and mechanisms to raise rents large amounts has meant that tens of thousands of rent stabilized units go unoccupied, contributing to our lack of housing supply. While there are some units that fall in this category, these claims are greatly exaggerated. Firstly, claims that the units cannot be rented are based on profit calculations on that individual unit – not overall profitability of a full building or portfolio. But most importantly, the number of such units is much lower than landlord interest groups suggest. A 2023 report by the Independent Budget Office found that most rent stabilized apartments are vacant less than one year. Their chart of the vacancy status of rent stabilized units shows that in 2017 and 2018 before the passage of HSTPA and until 2020, the annual number of rent stabilized units that remained vacant for more than one year was in the vicinity of 8,000. In 2021 and 2022, the number was 12,000-13,000.[13] A net increase of about 5,000 units that are remaining vacant for extended periods of time is one-fifth of the 25,613 units that Community Housing Improvement Program (CHIP) reported vacant based on its own survey.[14]

A variety of programs exist to assist owners with the costs of retrofitting and operating their rent stabilized buildings. When owners need to make upgrades to their buildings, increasing rents on tenants is by no means the only option.These programs are an essential component of simultaneously maintaining housing affordability and building quality.

ANHD members utilize a variety of low-interest loans and tax exemption programs for moderate to major rehabilitation of occupied buildings. These programs assist with upgrades to heating, mechanical and electrical systems, plumbing, roofs, and building envelopes. Programs are also available for reducing operating costs of existing buildings that carry high utility costs and real estate taxes. These programs are accessible to all rent stabilized housing owners, whether for-profit or not-for-profit, and whether the buildings have regulatory agreements and/or subsidies beyond rent stabilization or do not.

Programs include, but are not limited to:

-

The J-51 program expired in 2022, but New York State has passed a law enabling New York City to implement its replacement, called the Affordable Housing Rehabilitation Program. J-51 provided a 34-year or 14-year exemption from the increase in real estate taxes resulting from rehabilitation work and a tax abatement that reduces existing real estate taxes by 8 ⅓% or 12 ½% of the cost of the work each year for up to 20 years, in exchange for affordability requirements.

-

The Participation Loan Program (PLP) provides a loan with a 1% interest rate of City Capital of up to $90,000 per unit, depending on the affordability. This funding can be combined with financing from a participating private lender. A full or partial tax exemption will be offered for moderate or substantial rehabilitation of building systems, structural improvements and modernization of apartment interiors to help reduce operating expenses.

-

The Multifamily Housing Rehabilitation Program (HRP) is available for buildings with over three units in need of moderate improvements and a need for reducing operating expenses. It provides a loan with an interest rate up to 3% using City capital. Projects using this program can borrow up to $35,000 per unit, plus an additional $10,000 for lead abatement, and get a full or partial tax exemption.

Landlords have claimed that they require large rent increases in order to comply with mandates to reduce building emissions. This claim omits the many available subsidy and incentive programs to help owners comply, as well as the long-term energy cost savings from improvements. Programs available to private operators of rent stabilized housing include:

-

The Affordable Multifamily Energy Efficiency Program (AMEEP) provides incentives for equipment upgrades to make a property more energy efficient and reduce monthly bills. AMEEP is available to owners of buildings where at least 25% of units pay below 80% AMI, even if they are not part of a formal affordable housing program. AMEEP will provide owners with incentives of up to $2,000/unit based on the retrofits undertaken.

-

The Multifamily Energy Efficiency Program (MFEEP)

-

The Multifamily Buildings Low-Carbon Pathways Program provides multifamily building owners financial incentives to implement low-carbon retrofits. The program offers four packages of incentivized energy upgrades that bring deep energy savings to major building systems. Available incentives range from $700 per dwelling unit for heating water systems to up to $5,300 per dwelling unit for upgrades to the building envelope.

-

NYC Accelerator Property Assessed Clean Energy (PACE) provides financing to multifamily building owners to fund energy efficiency and renewable energy projects. It offers long-term, fixed-rate financing, covering up to 100% of project costs with no cash up-front from the owner.

-

The Green Housing Preservation Program is available for properties with a minimum of three units and a maximum of 50,000 square feet in order to reduce building energy usage by at least 20%. HPD will lend up to $50,000 per residential unit for all buildings requiring moderate rehabilitation work and up to $80,000 per residential unit for 3-15 units buildings requiring a more significant scope of work.

-

The Solar Electric Generating System (SEGS) Tax Abatement provides a four-year tax abatement for the construction of a solar electric generating system to incentivize building owners to install cleaner, more reliable power and reduce greenhouse gas emissions. SEGS provides a four-year tax abatement of 5% of eligible expenditures, up to $62,500 per year for four years or the building’s annual tax liability, whichever is less.

-

The FlexTech Technical Assistance Program helps owners complete an energy study of their building to identify and evaluate opportunities to reduce energy costs and incorporate clean energy into capital planning. The FlexTech program funds up to 75% of an energy study to produce an objective, site-specific, and targeted study on how best to implement clean energy and/or energy efficiency technologies.

These programs allow owners, for-profit and non-profit alike, to make needed building improvements and reduce operating costs while maintaining affordability for tenants.

We urge the Board to take the fact that rent stabilized tenants are unable to bear the cost of large – and in many cases, any – increases to legal rents. There exists a myriad of government programs to assist owners with operating costs, banks offer (re)financing options to responsible owners, and owners should take advantage of all such avenues instead of passing the bill to tenants who cannot afford the increases and will lose their homes. In the many cases where buildings are over-leveraged because owners expected to profit off of tenant displacement and deregulating units before the passage of the Housing Stability and Tenant Protection Act of 2019, the Rent Guidelines Board should not serve as a bail out system for bad investments. The Board must take its responsibility to keep tenants in their homes seriously.

Thank you for the opportunity to submit testimony. Contact Lucy Block, Senior Research and Data Associate, at lucy.b@anhd.org with questions.

[1] National Equity Atlas Rent Debt Dashboard, New York State, Accessed April 22 2024. https://nationalequityatlas.org/rent-debt.

[2] 2023 NYC Housing and Vacancy Survey Selected Initial Findings, Table 19, https://www.nyc.gov/assets/hpd/downloads/pdfs/about/2023-nychvs-selected-initial-findings.pdf.

[3] Ibid, Table 18.

[4] Ibid, Table 15.

[5] Ibid, Table 21.

[8] 2023 NYC Housing and Vacancy Survey Selected Initial Findings, p.5. https://www.nyc.gov/assets/hpd/downloads/pdfs/about/2023-nychvs-selected-initial-findings.pdf.

[9] NYC Rent Guidelines Board, 2024 Income and Affordability Study, p.32. https://rentguidelinesboard.cityofnewyork.us/wp-content/uploads/2024/04/2024-IA-Study.pdf.

[10] 2023 NYCHVS, Table 9 and Figure 6.

[11] ANHD, Data brief: we have the least housing where renters need it most. March 26, 2024. https://anhd.org/report/data-brief-we-have-least-housing-where-renters-need-it-most.

[12] City Limits, NYC Shelter Count. https://citylimits.org/nyc-shelter-count/.

[13] New York City Independent Budget Office, Most Rent Stabilized Apartments Do Not Remain Vacant Year-to-Year. https://www.ibo.nyc.ny.us/iboreports/most-rent-stabilized-apartments-do-not-remain-vacant-year-to-year-august-2023.html.

[14] Community Housing Improvement Program, CHIP Survey Shows More Than 20,000 Permanently Empty Apartments Could be Available with Simple Reforms to Rent Laws. https://medium.com/@CHIPNYC/chip-survey-shows-more-than-20-000-permanently-empty-apartments-could-be-available-with-simple-e5a7b16c4e72.