About the Association for Neighborhood and Housing Development

Eight grassroots local housing groups established the Association for Neighborhood and Housing Development (ANHD) in 1974 to support the development and preservation of affordable housing in New York City. Today, ANHD stands as one of the City’s lead policy, advocacy, and technical assistance and capacity-building organizations. We maintain a membership of 80+ neighborhood-based and city-wide not-for-profit organizations that have affordable housing and/or equitable economic development as a central component of their mission. We are an essential citywide voice, bridging the power and impact of our member groups to build community power and ensure the right to affordable housing and thriving, equitable neighborhoods for all New Yorkers. We value justice, equity and opportunity, and we believe in the importance of movement building that centers marginalized communities in our work.

Our member organizations rely on us for technical assistance and capacity-building resources that allow them to maximize their resources, skills and impact. The support services, research, analysis, public education and coalition building we do helps to identify patterns of local neighborhood experiences and uplift citywide priorities and needs. Our work translates into the capacity to win new programs, policies, and systems that ensure the creation and preservation of deeply and permanently affordable housing, and economic justice.

About the United for Small Business New York City Coalition

ANHD is also a member and convener of United for Small Business NYC (USBnyc), a coalition of 15 community groups across the city fighting to protect small businesses and non-residential tenants from the threat of displacement, with a focus on owner-operated, minority-run businesses that serve low-income and minority communities. Over the last five years, USBnyc has been a leading voice on equitable policy change for commercial tenants in New York City. The coalition has played a central role in the establishment of protections against commercial tenant harassment and the creation of the city’s Commercial Lease Assistance program to provide pro bono legal services for low-income business owners. We have also highlighted a range of policy issues including the scarcity of comprehensive data on the city’s commercial corridors, the negative impact of inflated commercial rents, and the inequitable treatment of immigrant businesses.

Since the beginning of the COVID-19 pandemic one year ago, commercial rent relief has surfaced as one of the most urgent needs of the small businesses our members work with.

Commercial Rent Relief

Small businesses and nonprofits are a critical component of New York State’s economic climate. In New York City alone, over a quarter of pre-pandemic jobs were at firms with 20 or fewer employees, with percentages far higher in some neighborhoods[1]. Statewide, these microbusinesses provide over 957,000 jobs, with total payroll close to $43 billion[2], and generate $950 billion in annual revenues. New York nonprofits employ over 1.4 million New Yorkers and comprise almost 18% of private employment in the state.[3]

New York is particularly dependent on the types of businesses that have struggled most during the pandemic, including those in the entertainment, hospitality, and service sectors. A national Federal Reserve study found that in 2020, 58% of firms who applied for financing did so to cover operating expenses like rent, a huge increase from previous years.[4] While many businesses received PPP loans from the federal government, these loans were primarily intended to cover payroll costs; most of the loan amount could not be dedicated to operating costs such as rent. Additionally, recent analysis shows that PPP loans were not equitably distributed and were less likely to reach businesses in low-income communities and communities of color[5]. We ask that you allocate $500 million in federal relief or other available monies to create an equitable and widely accessible commercial rent relief program.

There has been no comprehensive rent relief program available to commercial tenants. Many commercial tenants have entered into individualized negotiations with their landlords, but commercial mortgages are structured to make rent forgiveness difficult without some form of external reimbursement[6].

We want to thank the legislature for your leadership in sponsoring the recent package of bills including the COVID-19 Emergency Protect Our Small Business Act passed earlier this month. This was a positive step forward that addresses some important issues for small businesses, like unemployment insurance premiums, third-party delivery fees, and commercial evictions. We believe that this legislation will provide a breath of relief to commercial tenants, but rent debt must be dealt with in order to prevent mass closures once the pandemic subsides. Property tax relief may benefit some commercial property owners, but is not guaranteed to benefit their tenants; and the relief from small business tax credits will be significantly delayed. Existing measures aimed at protecting commercial tenants do not address the reality of many small business owners: if they do not have sufficient revenue to maintain operations, they will not wait for an eviction notice. They will exit their lease, cease operations, or file for bankruptcy, as many have already done.[7]

To avoid this, the legislature should create a path to recovery that allows commercial tenants and property owners to share the burden of the pandemic with support from the state. Small businesses and nonprofits that have lost significant revenue due to COVID-19 and are unable to pay rent should qualify for a small rent abatement. Property owners whose tenants have applied for and received the abatement should be eligible for reimbursement, to be administered by the State Department of Economic Development and funded by federal relief or any other available source of funding. In order for the program to reach the most vulnerable businesses and nonprofits, it is important that all eligible commercial tenants receive the abatement and that their landlords be eligible for relief. Otherwise, commercial landlords who are seeking to warehouse their property or get rid of a longstanding tenant may refuse to participate. We believe that commercial rent relief must be a critical component of a statewide economic recovery program.

Repurposing Underutilized Commercial Space for Housing

We support the intention of Repurposing Underutilized Commercial Space for Housing, which would override local zoning to allow residential conversions of small hotels and commercial office buildings to affordable housing.

However, we believe this change should exempt any land zoned for manufacturing and industrial uses. The industrial sector creates and transports many of the things that keep New York running. Industrial businesses have played a critical role in manufacturing and distributing personal protective equipment, medicine, and food, especially throughout the pandemic, which has shown that local production and distribution capacity is a matter of basic economic security.

Industrial businesses have specific physical needs; they tend to occupy large, low-scale buildings, with the most intensive activity on the ground floor, and rely on access to road, train, and water transportation. The need for appropriate zoning and transportation infrastructure means that without certain land use protections, industrial businesses are at higher risk of displacement.

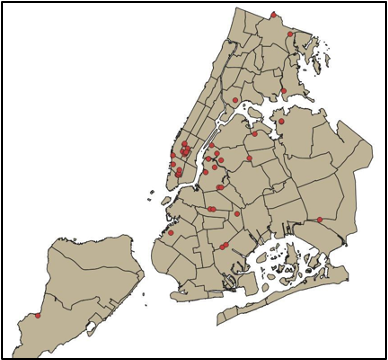

In New York City, there are approximately 45 hotels eligible for conversion under this provision that fall within manufacturing zones. This map shows the locations of hotels in manufacturing-zoned land that would be eligible for conversion to residential. It includes buildings in several of the city’s industrial business zones, including Long Island City and North Brooklyn.

Despite extensive rezonings of industrial land in the last half-century, New York City has for the last 15 years committed not to support residential rezonings in industrial business zones[8], as it has become clear that the incompatible nature of these land uses creates quality-of-life challenges for residents and intense speculative pressure on industrial businesses[9]. In order to achieve the goal of effectively repurposing underutilized commercial space without undercutting the manufacturing sector, we ask you to exclude manufacturing-zoned land from this provision.

We strongly support the requirement for affordable and supportive housing in these Underutilized Commercial Space conversions (excluding manufacturing zones). However, we believe the current proposal’s affordable housing requirements do not do enough to make sure we maximize the public benefit of these conversions and address the needs of those most impacted by the affordability crisis. We ask that the legislature requires deeper levels of affordability, given that conversions are likely to cost less than new development. We also support allowing the affordable units to be funded by city subsidy programs as well as state programs and adding additional restrictions to disincentivize the option of payment in lieu.

Thank you again for the opportunity to testify. If you have any questions or need more information, please contact Karen Narefsky at karen.n@anhd.org

****

[1] https://anhd.org/report/taking-care-business-understanding-commercial-displacement-new-york-city

[2] https://www.osc.state.ny.us/files/reports/special-topics/pdf/small-business-nys-2019.pdf

[3] https://www.osc.state.ny.us/files/reports/special-topics/pdf/economic-nonprofits-2019.pdf

[4]https://www.fedsmallbusiness.org/medialibrary/FedSmallBusiness/files/2021/2021-sbcs-employer-firms-report

[5] https://anhd.org/blog/new-yorks-small-businesses-left-out-paycheck-protection-program

[6] https://www.nytimes.com/2020/10/11/opinion/nyc-commercial-rent-reform.html

[7]https://www.bloomberg.com/news/features/2020-09-29/new-york-city-bankruptcies-2020-pivotal-point-for-business-as-covid-cases-rise

[8]https://edc.nyc/industry/industrial-and-manufacturing

[9]https://prattcenter.net/uploads/600006/1597180308805/making_room_for_housing_and_jobs_Exec_Summary_0.pdf