Introduction

As much as New York City is a city of renters, nearly a third of New Yorkers own their own homes. Responsible, affordable homeownership has long been recognized as an important way for people to build wealth and move into the middle class. Yet, lower-income people and people of color have consistently been locked out of the housing market or targeted with harmful products and practices. From the decades prior to the passage of the Community Reinvestment Act (CRA) and Fair Housing laws when banks redlined communities of color to the more recent financial crisis when lenders were targeting these same populations with unscrupulous, high-cost loans.

Today, the pendulum seems to have swung back. Low- and moderate-income New Yorkers and people of color face significant barriers to homeownership in NYC. This is due to both a lack of access to credit a and a lack of affordable inventory, coupled with the fact that people of color very often lack the savings needed to purchase and maintain a home, especially when compared to their white counterparts.

Recent Trends in 1-4 Family Lending in New York City from 2012 to 2014

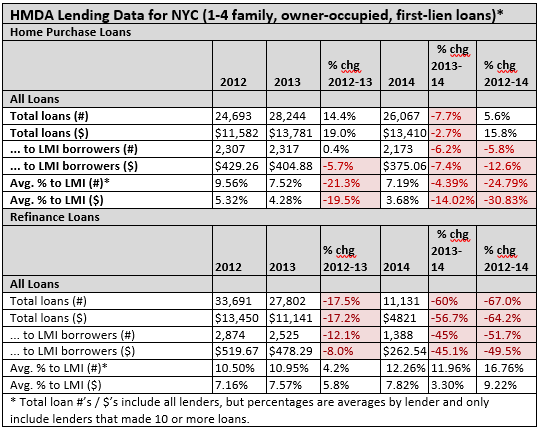

Home Purchase loans citywide declined by 7.7% from 2013-14, but are up 5.6% from 2012. The decline in refinance lending in the city mirrors national trends, as most homeowners had already taken advantage of historically low interest rates. On average, just 7.2% of home purchase loans went to low- and moderate-income borrowers in 2014, down from 7.5% in 2013.

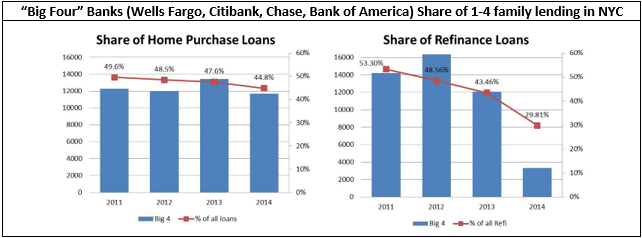

The share of lending by the “Big 4” banks (Chase, Citibank, Bank of America and Wells Fargo) in NYC has been steadily declining, from 50% of home purchase loans in 2011 to 45% in 2014.

Non-CRA covered lenders are increasing their presence: In 2014, 29.4% of all home purchase loans were originated by non-CRA covered lenders, up from 22.6% in 2011. The percentage of non-CRA covered lenders was 45.4% for refinance loans in 2014.

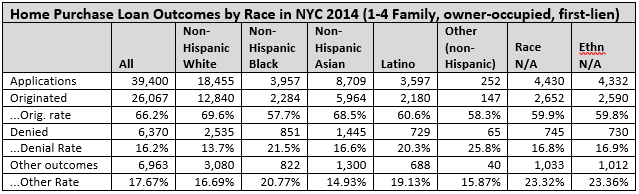

Racial disparities persist. Twenty-two percent of New Yorkers are Black and 29% Latino, yet in 2014 only 8.76% of home purchase loans went to non-Hispanic Black Borrowers and 8.36% to Hispanic borrowers of any race. Similar disparities appear in the percentage of applications and denial rates.

Addressing these disparities will require a concerted effort on the part of government, banks, and bank regulators. This involves increasing the inventory of affordable homes to purchase, making credit available equitably and responsibly, increasing financial assistance, and increasing access to homeownership and financial counseling. It also means holding banks accountable for irresponsible practices that lock lower-income borrowers and people of color out of the housing market. The City and financial institutions, especially those covered by the CRA, have an obligation to ensure that this opportunity of homeownership is made equitably to lower-income and minority people and communities throughout the City.

Home Prices Rise, Lending Declines

The City and country are still struggling after the financial collapse. The largest banks played a major role in setting up and profiting from making irresponsible loans and securitizing them to sell on the secondary market, which ultimately led to this collapse. They have a particular obligation to help the City recover.

Nationwide, and citywide, home prices have been steadily increasing since mid-2011 and are approaching pre-recession levels, which is concerning given how inflated some of the home prices were before the market crashed. This just puts homeownership further out of reach for lower-income New Yorkers. The Federal Reserve Bank of New York reports the price of homes throughout NYC to be higher than they were a year earlier, by at least 7% in all five boroughs, with Brooklyn home prices up over 9% from a year earlier (as of June 2015)1 . According to one industry publication, the average sales price of coops and condos in Manhattan was over $1.8 million in the second quarter 2015, up 11% from a year earlier. The median sales price was $980,000, just shy of the peak of $1.025 million before the housing crisis hit2 At the same time, mortgage interest rates have been relatively low for many years, hovering between 3.5% and 4.5% for the past three years. This combination of increased equity and low interest rates likely contributed to the refinance boom nationwide in 2012, but they dropped off sharply in 2013 and continued to decline into 2014.

From 2012 to 2014, home purchase lending increased by 5.6% (up 14% in 2013, then down 7% in 2014). Meanwhile, loans to lower-income borrowers declined by 6%, with most of that decrease happening from 2013 to 2014. The percentage of lending to LMI borrowers was quite low to begin with. On average, just 7% of home purchase loans were to LMI borrowers in 2014, down from 7.5% in 2013. HMDA-reportable refinance loans increased over 26% from 2011 to 2012 and then declined 67% from 2012 to 2014 (down 52% to lower-income borrowers).

Banks Pulling Back and Non-Bank Lenders Step In

1-4 family lending continues to be dominated by a few large banks, but non-bank lenders are increasing their presence, which is concerning. Independent mortgage companies and credit unions are not covered by the CRA, but credit unions have much smaller share than either banks or non-bank lenders. In 2014, 29.4% of all home purchase loans were originated by non-CRA covered lenders, up from 22.6% in 2011. The percentage of non-CRA covered lenders was 45.4% for refinance loans. In fact, online lender Quicken Loans originated the most refinance loans in the city in 2014.

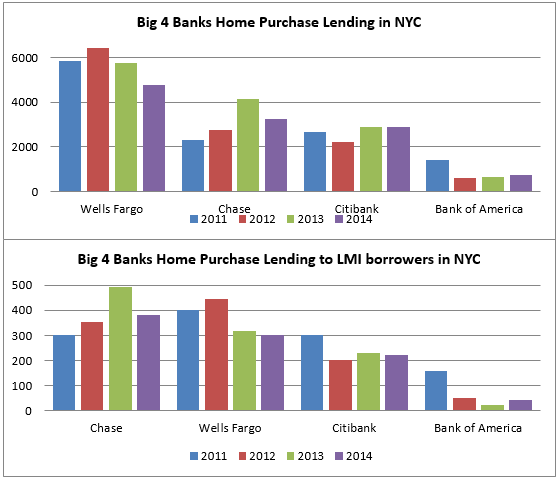

The “Big 4” banks’ – Wells Fargo, Citibank, Chase, and Bank of America – share of lending has been declining in NYC and nationwide. Collectively they accounted for 45% of home purchase loans in the City in 2014, down from 50% in 2011. They dropped from 53% to 30% of refinance loans in that same period. Historically HSBC had been among the top lenders in NYC, but their volume has dropped considerably over the years. While Wells Fargo has only 22 full service branches in NYC, they have additional mortgage offices and a very large presence in the mortgage market. Wells Fargo made 18% of all home purchase loans in the City and 14% of all loans to LMI borrowers in 2014, similar to 2013. In 2012, however, they made closer to 25% of all loans and 19% of loans to LMI borrowers). Chase has a much larger branch presence than any other bank in the city. In 2013, they made 14.6% of all home purchase loans and 21% of loans to LMI borrowers. In 2014, that dropped to 12.5% of all loans citywide and 17.6% of loans to LMI borrowers.

We recognize that some of the smaller banks face unique challenges in competing with the larger national and regional banks, especially those that may not have the branch and office presence or budgets to compete. Nevertheless, like all banks, they have an obligation to lend equitably where they do lend. Thus, it is concerning the number of bank lenders that are pulling out of 1-4 family lending. Dime discontinued its 1-4 family lending in 2015; BankUnited announced the same in 20163 , and Apple, Flushing and Signature already make a very low volume, as they concentrate lending in other areas. While not every bank will engage in every area of CRA, this contributes to the trend of fewer and fewer CRA-covered bank lenders in the market.

Racial Disparities Persist

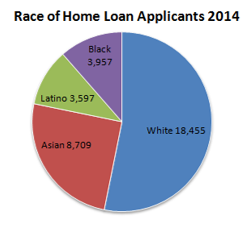

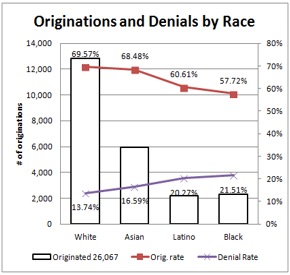

Racial disparities persist in home lending. 22% of New Yorkers are Black and 29% Latino, yet in 2014, only 8.36% of home purchase loans in NYC went to non-Hispanic Black Borrowers and 8.36% to Hispanic borrowers of any race. There is also a vast disparity in the number of home purchase loan applications among racial groups. Blacks only submitted 10% of all applications and Hispanics 9% in 2014. Likewise, beyond the disproportionately low number of Black and Hispanic applicants, those groups also received comparatively high rates of home purchase loan denials. While only 13.7% of White applications were denied citywide, 21.5% of Black and 20.3% of Hispanic applications were denied.

Racial disparities persist in home lending. 22% of New Yorkers are Black and 29% Latino, yet in 2014, only 8.36% of home purchase loans in NYC went to non-Hispanic Black Borrowers and 8.36% to Hispanic borrowers of any race. There is also a vast disparity in the number of home purchase loan applications among racial groups. Blacks only submitted 10% of all applications and Hispanics 9% in 2014. Likewise, beyond the disproportionately low number of Black and Hispanic applicants, those groups also received comparatively high rates of home purchase loan denials. While only 13.7% of White applications were denied citywide, 21.5% of Black and 20.3% of Hispanic applications were denied.

What It Will Take

Addressing these disparities will require a concerted effort on the part of government, banks, and bank regulators. This involves increasing the inventory of affordable homes to purchase, making credit available equitably and responsibly, increasing financial assistance, and increasing access to homeownership and financial counseling. It also means holding banks accountable for irresponsible practices that lock lower -income borrowers and people of color out of the housing market.

Addressing these disparities will require a concerted effort on the part of government, banks, and bank regulators. This involves increasing the inventory of affordable homes to purchase, making credit available equitably and responsibly, increasing financial assistance, and increasing access to homeownership and financial counseling. It also means holding banks accountable for irresponsible practices that lock lower -income borrowers and people of color out of the housing market.

Nonprofit housing counselors are committed to helping people achieve homeownership and have a good understanding of quality programs that responsibly give lower-income people a chance at this. The New York Mortgage Coalition, a HUD intermediary, and Neighborhood Housing Services, a HUD certified direct provider of counseling services, both connect prospective borrowers to homeownership counseling through their networks citywide. Staff at these agencies know first-hand the challenges lower-income homebuyers face, especially in recent years as underwriting criteria has stiffened and down payment assistance has declined.

Homeownership can lead to financial stability for lower-income families if they are able to get into an affordable home. The Dodd Frank legislation implemented an “Ability to Repay” (ATR) standard to require lenders to make sure that consumers could actually afford to repay their mortgage. As part of that rule, the law presumes that a lender has met those requirements and issued a safe home loan by giving a consumer a “Qualified Mortgage” (QM). QM loans require a maximum 43% debt to income ratio and also limit certain points and fees and predatory product features. This was an important step towards protecting borrowers from potentially predatory products. The new QM rules went into effect January 2014.

It is imperative for the city and financial institutions to exhaust all options to make affordable rental and homeownership opportunities available to lower-income and minority borrowers.

Quality Home Purchase Programs For Lower-Income Borrowers Should Have the Following Characteristics

- Dedicated loan officers, underwriters, and loan processors who are fully knowledgeable about their products and able to make approval decisions in a timely manner. Staff should be responsive and available to housing counselors. Loan officers should be culturally competent, speak the languages of the communities they serve, and be visible in the community so that service providers and prospective homebuyers can speak to them directly.

- Responsive products with Reasonable down payment requirements and financial assistance: In a high-cost city like New York City, 20% down payment can be impossible for many borrowers and is not as good a predictor of successful mortgage payment as pre-purchase counseling and income. That being said, coops are a common source of more affordable homeownership and many require a 10%-20% down payment, making financial assistance all the more important. Financial assistance towards closing costs, down payment, and/or lower interest rates can come in many forms and should have the ability to be layered with other government programs. Portfolio products can often enable a bank to waive mortgage insurance and provide more flexible underwriting. Banks should ensure products extend to coops, including limited equity HDFC coops, another common source of affordable homeownership.

- Reasonable credit scores and income requirements that are achievable and related to the ability to repay the loan. Banks should also consider alternative forms of credit, particularly for immigrants who may not have previous loans or credit cards, but have other ways of demonstrating creditworthiness, such as on-time payment of bills and rent over many years.

- Homebuyer counseling: Any first-time homebuyer assistance should require pre-purchase counseling and connect potential homebuyers to a qualified provider. In one of the largest studies to date that evaluated 75,000 mortgages originated from 2007 to 2009, NeighborWorks found that borrowers who received pre-purchase counseling were one-third less likely to become 90+ days delinquent over the two years after receiving their loan.

On the positive side, many banks are working with neighborhood-based organizations to reach lowerincome borrowers and more banks are creating portfolio products targeted to low- and moderateincome borrowers with low down payments and financial assistance. It must be noted, however, that many of the products are available to both LMI borrowers and to any borrower of a home in an LMI census tracts. Thus, we must look at both the products available and who is using them.

In addition to portfolio products, there are also existing affordable homeownership programs available. For example, banks can offer loans insured by the State of New York Mortgage Agency (SONYMA) or backed by federal agencies like Fannie Mae and loans are well-defined with low down payments, prepurchase counseling, and can connect borrowers to financial assistance for closing and down payment costs. It is unfortunate that Chase, the largest bank in the City, no longer offers SONYMA loans. Banks can also offer SONYMA Down Payment Assistance Loans (DPALs) which are technically 0% interest loans but when certain conditions are met, the loan is forgiven and treated like a grant. Another valuable program is the First Home Club, run by the Federal Home Loan Bank of NY, which offers matching grants for qualified first-time homebuyers who successfully complete a homebuyer class and save with a participating bank. Above all, lenders need to be in tune with the incredible diversity of NYC and provide products and staff that can respond to these needs, which can change from borough to borough and block to block.

Note on Data

This report analyzes Home Mortgage Disclosure Act (HMDA) data, focusing on 1-4 family, owner-occupied, first-lien home purchase and refinance loans. It includes all types of loans (Conventional, FHA, or VA). For racial disparities, we breakdown in the following racial/ethnic categories:

- White: Race is “White” and Ethnicity is “Not Hispanic or Latino, Not Provided or Not Applicable.”

- Asian: Race is “Asian” and Ethnicity is “Not Hispanic or Latino, Not Provided or Not Applicable.”

- Black: Race is “Black or African American” and Ethnicity is “Not Hispanic or Latino, Not Provided or Not Applicable.”

- Latino: Ethnicity is “Hispanic or Latino.”