The Real Estate Lobby Says Rent Reform Will Prevent Them from Investing in Buildings, But the History of One Building Complex Tells a Different Story

The real estate lobby and their allies have begun a scaremongering campaign about the package of tenant protections passed in Albany in June. Those reforms closed many of the rent-increase loopholes that drove our City’s displacement crisis by actively incentivizing speculative real estate investors to drive out moderate-rent paying tenants. It was a major victory for tenants and all New Yorkers who care about affordable housing.

But the real estate lobby is claiming that if landlords can’t take advantage of big rent increase loopholes, they won’t be able to make “healthy” investments in the quality of the housing stock. This recent Wall Street Journal editorial is a typical example, citing Manhattan’s huge Stuyvesant Town building complex to make their case by quoting the owner saying, “In light of the recent legislation, we are in the process of evaluating capital investments at Stuy Town… Maintenance, such as fixing leaks, must legally continue. But … renovations to vacant units would stop.” The editorial then mocks the leader of the buildings’ Tenant Association for her support of the stronger tenant protections saying, “Wait until neighboring apartments deteriorate around her.”

So close, Wall Street Journal, so close. You picked the right example, but you drew the wrong conclusion. Let’s look at what the case of Stuyvesant Town-Peter Cooper Village actually tells us about real estate speculation, tenant displacement, and the need for strong rent laws. It’s not what you think.

Built many decades ago as a moderate-income housing development, the 11,227 apartments of Stuyvesant Town-Peter Cooper Village were a jewel of New York City affordable housing. Until the complex was sold by Met Life in 2006, the buildings were a notable island of decent, stable, and affordable housing for the moderate- and middle-income tenants who lived there. And Met Life held onto the buildings for decades as they returned a modest, yet steady and safe profit.

Then in 2006, Met Life sold the buildings to a partnership of the big New York City developer Tishman-Spyer and the huge private equity fund BlackRock. That sale was a headline-making example of what became known as “predatory equity” investment – the business model was clearly speculative and explicitly based on pushing-out the existing tenants.

The buyers themselves made that clear in the numbers. According to a 2009 ANHD analysis, the record breaking $5.6 billion sale broke all the standard real estate price metrics. The price was more than double what experts generally considered the reasonable industry standard based on the rent roll. And, the new mortgage debt was wildly out of proportion with the rents. Observers knew there was something fishy about the deal.

But Tishman-Speyer and BlackRock had a plan to make up for the fact that the rent roll didn’t justify the sales price – and make a windfall profit in the process – by pushing out tenants. ANHD’s analysis of the actual underwriting for the deal showed that the buyers projected that approximately 3,000 affordable, rent-regulated apartments would be turned over within the first five years and brought to market rate using the rent increase loopholes. That’s an extraordinary 33% turnover rate, far above the norm, that could probably only be achieved through tenant harassment. By 2015, as we projected, a revolving cast of owners had succeeded in converting over 50% of the buildings’ apartments to market rate.

With each conversion, the rent increased from a median of $1,700 for the regulated units to a median of $3,500 for the market-rate apartments. By 2015, New York City lost over 5,800 affordable units at Stuyvesant Town that before had been available for New Yorkers of modest means.

The centerpiece of the strategy was the Individual Apartment Improvement (IAI) rent increase loophole, which allowed the owner to make unnecessarily expensive upgrades to a vacant apartment and then pass on the costs to the new tenant in the form of a large, permanent rent increase. This is one of the major loopholes that was closed in June.

So, what did the Wall Street Journal get wrong? First, Stuyvesant Town isn’t an example of what’s wrong with the strengthened tenant protection laws, it’s an example of how the loopholes that were finally closed drove speculation and displacement.

In fact, the recent history of Stuyvesant Town is a microcosm of what was happening in many neighborhoods around the city, as a pumped-up real estate market took advantage of the rent increase loopholes to turn thousands of rent regulated buildings into unstable, speculative assets. Like at Stuyvesant Town, it is generally the case that rent regulated apartment buildings used to be slow, steady investments, and that was also good for tenants. If you were a landlord or an investor and you knew that you could only get the modest rent increases approved by the City Rent Guidelines Board every year, you would only buy or sell a building for a price that allowed you to make a decent profit while the rents remained steady. For a good building owner, it was a safe but slow approach to building investing. And that was how rent regulation preserved affordability while also discouraging speculation.

The losers under the speculative market of the last 20 years have been tenants and all New Yorkers who care about affordable housing. Since 1994, our City has lost over 300,000 units of rent regulated housing. And, from 2014-2017 alone, we lost 166,000 apartments renting below $1,500. That’s a dramatic loss of our City’s affordable housing stock and has led to the displacement and homelessness crises we face today.

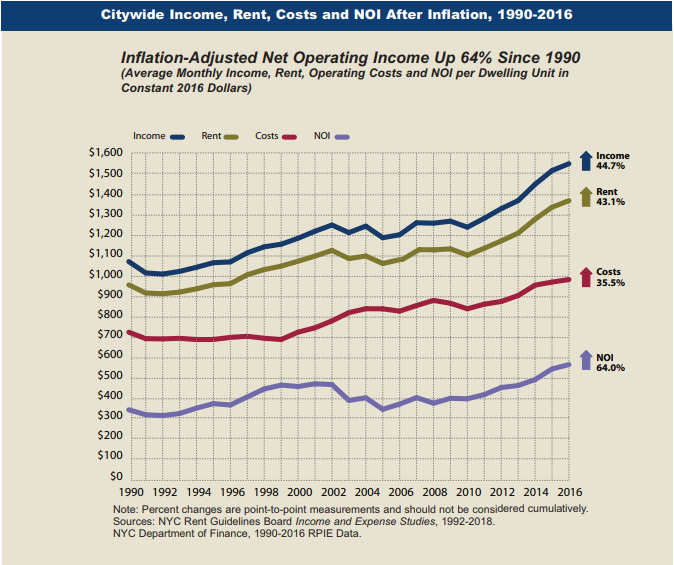

The landlord lobby is claiming that closing the rent increase loopholes will mean that the City’s housing stock won’t get the investment it needs. But the data indicates otherwise: a recent Rent Guidelines Board report shows that while building operating cost have gone up by an adjusted average of 32.9% since 1990, over the same period of time building incomes went up by 39.4% and potential owner profit (net operating income) went up by 53.1%. It’s clear that owners generally have the building income to make basic repairs and make occasional, necessary improvements.

If you talk to the tenants who live in Stuyvesant Town, they will tell you that they want basic repairs and maintenance, which they expect the owners will provide since city code enforcement inspectors can always be brought in and since being a decent landlord is generally good business in a strong real estate market. The tenants will also tell you they were dismayed by how quickly their building complex was hemorrhaging affordable units, and that they were frightened of becoming the next victim of a weakened system of rent regulation. That’s why they fought with the Housing Justice for All Coalition for the law that passed in June.

So, what will the real consequences of the new tenant protection law be?

Most importantly, we expect to see fewer tenants pushed out and fewer affordable units lost. Since this closing of the rent law loopholes will take a lot of the speculative oxygen out of the real estate market, we expect to see building prices return to less speculative, less predatory levels. We don’t expect to see building conditions deteriorate – landlords will still be able to make repairs with profit levels at historic highs and city inspectors will still be on the job to enforce decent conditions. However, we might see less construction as harassment and that’s a good thing.

The rent law reforms will have a significant impact, and we should all be watching carefully to see what happens with the real estate market and affordable rental housing in the coming years. In the meantime, don’t believe this false real estate lobby narrative being peddled in the media.