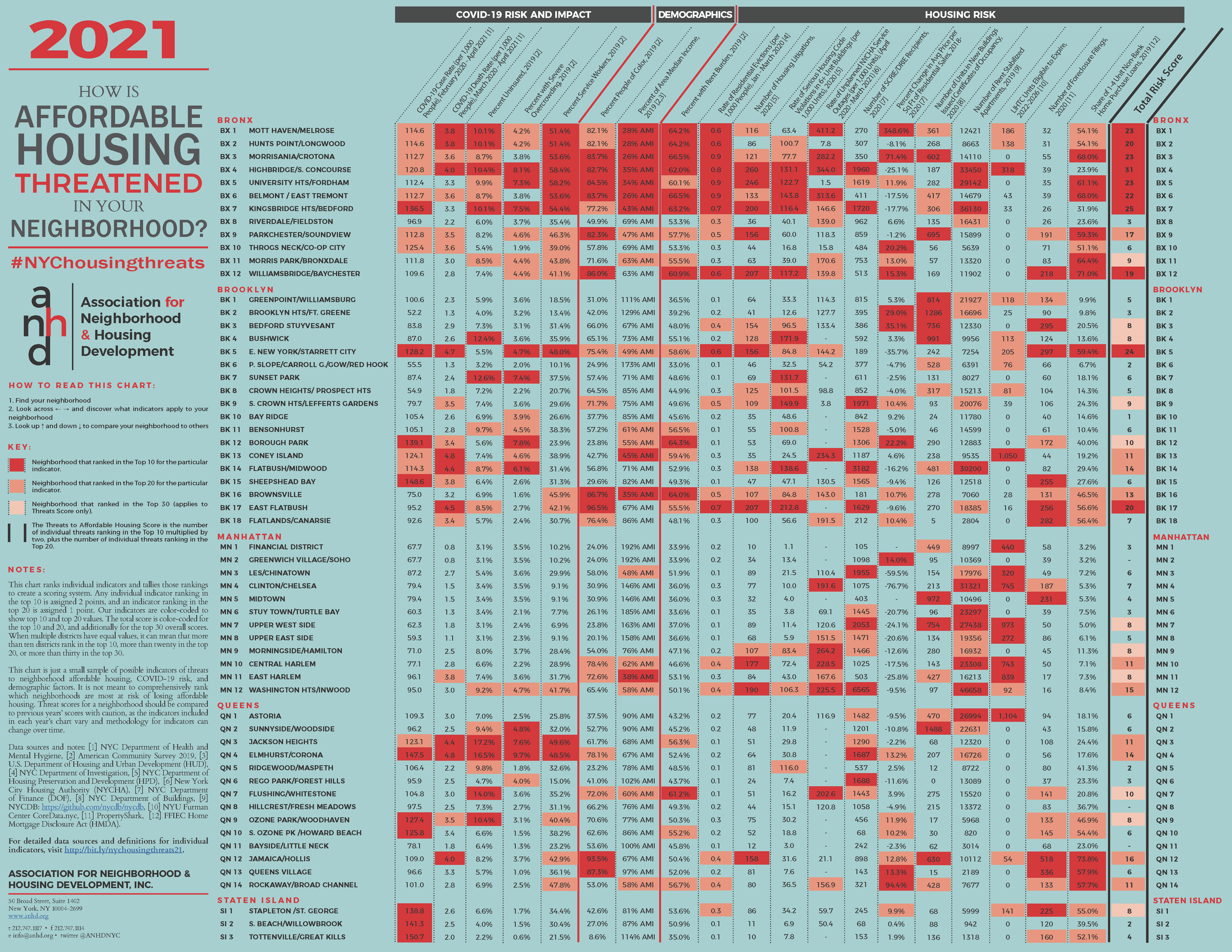

With the onset of the pandemic last year, we incorporated COVID-19 impacts and risks into our Housing Risk Chart analysis in order to paint a more holistic picture of the current housing and economic threats impacting New York City’s neighborhoods. This year, we have continued that analysis to understand ongoing impacts of the pandemic.

In the 2021 edition of ANHD’s Housing Risk Chart How is Affordable Housing Threatened in Your Neighborhood?, we saw the same trend as in the first few months of COVID and in last year’s Housing Risk Chart: the worst COVID impacts and the greatest housing risks continue to be in Black, Indigenous, and People of Color (BIPOC) neighborhoods.

ANHD also found that neighborhood disparities in COVID deaths are much greater than the disparities in cases. For example, Elmhurst and Corona residents are only two times more likely to get COVID than residents of the Financial District, but six times more likely to die from it.

This year’s chart reveals ongoing deep inequities in our city where the worst impacts of COVID-19 occur in BIPOC neighborhoods, which also face a multitude of threats to stable, safe, affordable housing. New NYCHA data illustrates alarming issues with building conditions in some of the wealthiest neighborhoods that otherwise face low COVID, economic, and housing threats.

As we transition to new city leadership, it is more important than ever that we adopt an integrated housing plan that invests in public housing, prioritizes ending homelessness, promotes racial equity, and provides permanent, deeply affordable housing to those who need it most.

ANHD’s 2021 Housing Risk Chart was made possible with support from the New York City Council, through their Community Housing Preservation Strategies program.

In addition to our PDF chart, we created an interactive map version of our 2021 Housing Risk Chart, showing the close correlation between overall risk and COVID-19 impact.

You can also view and download the Risk Chart data in table format below. When citing this information, please be sure to credit ANHD with the following language: “Original research and analysis by the Association for Neighborhood & Housing Development (ANHD), https://anhd.org/report/how-affordable-housing-threatened-your-neighborhood-2021.”

Key Findings

General

-

At this late stage of the pandemic, we continue to see the worst COVID impacts and the greatest housing risk in Black, Indigenous, and People of Color (BIPOC) neighborhoods. Seven of the ten districts with the highest rates of death from COVID are over 75% people of color, and all of them rank in the top 20 citywide across all risk factors. This is unfortunately the same trend we saw in the first few months of COVID and in last year’s Housing Risk Chart.

-

Neighborhood disparities in COVID deaths are much greater than the disparities in cases. Elmhurst and Corona (QN 4) residents are only about two times more likely to get COVID than residents of the Financial District (MN 1), with 147.5 cases per 1,000 residents versus 67.7 throughout the pandemic, but six times more likely to die from it, with 4.8 deaths per 1,000 people versus 0.8.

-

Many homeowners have been at risk of displacement during COVID if they didn’t have access to loan modifications or forbearance or faced other financial challenges. This is reflected in most top-ranking districts for foreclosure filings and share of non-bank home loans being largely BIPOC:

-

Six of the ten districts with highest numbers of foreclosure filings and eight of the ten districts with the highest shares of loans made by non-bank lenders are in districts that are more than 75% people of color. As ANHD has reported in the past, non-bank lenders are more prevalent in Black and Latinx neighborhoods. but they are not covered by the Community Reinvestment Act and employ more higher-cost Federal Housing Administration loans than bank lenders, putting Black and Latinx borrowers at greater risk of foreclosure and financial distress.

-

-

New NYCHA data: thanks to data scraping efforts by the Housing Data Coalition, this year we were able to aggregate unplanned service outages in public housing during the first year of the pandemic (April 2020-March 2021) by community district.

-

The highest rate of unplanned service outages per 1,000 NYCHA units was in Mott Haven/Melrose (BX 1), with 411.2 outages per 1,000 units, where the Mott Haven, Patterson, Mitchel, and other developments are located.

-

Other community districts with the highest rates of outages were in Highbridge/South Concourse (BX 4) with 344.0 per 1,000 units, Belmont/East Tremont (BX 6) with 313.6, Morrisania/Crotona (BX 3) with 282.2, and Morningside/Hamilton Heights (MN 9) with 264.2.

-

The Bronx

-

Eight out of the ten highest risk districts across all indicators are in the South and Northwest Bronx (BX 1, 2, 3, 4, 5, 6, 7, 12), which are all at least 75% people of color. Bronx districts 1 through 7 also rank among the lowest area median incomes citywide (26 to 43% AMI).

-

Those districts ranked among the highest for executed eviction rates pre-pandemic, between 0.6 and 0.9 per 1,000 residents between the months of January through March 2020. Those districts’ comparatively high eviction rates during those months mirror their high rankings in 2019 as shown in last year’s Housing Risk Chart, despite overall numbers being lower due to bans on the execution of evictions during the pandemic.

-

This is consistent with the recent New York Times coverage of ANHD’s research that showed eight of the ten zip codes with the highest rates of eviction filings during the pandemic were in the Bronx.*

-

The same districts experience remarkably high rates of rent burden (60.1-66.5% of households pay more than 30% of their income on rent), serious housing code violations (63.4-143.8 class C violations per 1,000 units), and housing litigations (86-246). This data shows a complex interaction of housing risks–while residents are experiencing poor conditions, lack of affordability, and threats of eviction, they are also pushing back in housing court for repairs and to stop harassment.

-

At the same time, the Bronx has four of the ten districts with largest increases in residential sale prices, putting tenants at even greater risk in the future as gentrification occurs and displacement pressures increase.

-

*Note: Current limitations on available housing court data prevent us from analyzing eviction filings at a community district level for the Housing Risk Chart, but the geographic trends we found at a zip code level in our March analysis are similar to pre-pandemic executed evictions.

Brooklyn

-

Four districts in Brooklyn ranked highest citywide for deaths from COVID: East New York/Starrett City (BK 5), Coney Island (BK 13), Flatbush/Midwood (BK 14), and East Flatbush (BK 17), with 4.7, 4.8, 4.4, and 4.5 per 1,000 people, respectively.

-

East New York/Starrett City, which is 75.4% people of color and 48.0% service workers, was also among the highest citywide for all risk factors. The district ranked among the highest for severe overcrowding (4.7%), pre-pandemic eviction rate (0.6 per 1,000 people), housing litigations (156), increase in residential sale prices (19.5%), foreclosure filings (297), and share of non-bank home loans (59.4%). Like many districts of the Bronx, along with COVID deaths, East New York is experiencing a diverse set of housing threats to both tenants and homeowners that interact in complex ways.

-

Coney Island has a high rate of severe overcrowding (4.6%) and among the lowest area median incomes (45% AMI) citywide, the highest rates of unplanned NYCHA services outages (234.3 per 1,000 units), and the largest number of expiring Low Income Housing Tax Credit (LIHTC) units (1,050).

-

Flatbush/Midwood has among the highest rates of overcrowding (6.1%) and serious housing code violations (138.6 per 1,000 units). It also has a very high number of SCRIE/DRIE recipients, low-income seniors who are highly vulnerable to COVID.

-

East Flatbush, which has the highest share of people of color citywide (96.5%) and a high rate of uninsurance (8.5%) and density of service workers (42.1%), also faces a multitude of housing risks: 0.7 pre-pandemic evictions per 1,000 people, 207 housing litigations, 212.8 serious housing code violations per 1,000 units, and 256 foreclosure filings.

-

Manhattan

-

In contrast to most housing risks which are concentrated in the Bronx, Brooklyn, and Queens, the expiration of affordable housing units financed with LIHTC is concentrated in Manhattan, including 440 units in the Financial District (MN 1), 320 in Lower East Side/Chinatown (MN 3), 745 in Clinton/Chelsea (MN 4), 973 on the Upper West Side (MN 7), 272 on the Upper East Side (MN 8), 743 in Central Harlem (MN 10), and 839 in East Harlem (MN 11). These expiring LIHTC units are reaching the end of their 30 year regulatory agreements and are at risk for being taken out of affordability. This has become even more of a concern recently, as some tax credit investors have fought to prevent non-profits from taking ownership of the buildings they developed, as seen in the Riseboro v. SunAmerica case.

-

No Manhattan districts ranked in the top 10 for COVID case or death rates and only East Harlem was in the top 20 for rate of COVID deaths (3.8 per 1,000 people).

-

While housing risks in Manhattan are generally low, half its districts had high rates of unplanned NYCHA service outages per 1,000 units: 191.5 in Clinton/Chelsea, 151.5 on the Upper East Side, 264.2 on in Morningside/Hamilton Heights, 228.5 in Central Harlem, 167.6 in East Harlem, and 225.5 in Washington Heights/Inwood. This indicator points to major disparities between Manhattan residents in private versus public housing.

-

Mirroring the trend of rent levels decreasing in areas hit least hard by COVID while increasing or remaining the same in areas hit hardest, residential sale prices mostly decreased across Manhattan between 2018 and 2020 – by as much as 76.7% in Lower East Side/Chinatown and 59.5% in Clinton/Chelsea. Only Greenwich Village/Chelsea saw a major increase of 14.0% per residential gross square foot. Residential sale volume was also very low in Manhattan compared to other boroughs.

Queens

-

Jackson Heights (QN 3), Elmhurst/Corona (QN 4), and Jamaica/Hollis (QN 12) ranked among the highest citywide for COVID deaths with 4.4, 4.8, and 4.0 per 1,000 people, respectively.

-

Jackson Heights and Elmhurst/Corona, the early epicenter of the pandemic in New York City, also have among the highest rates of uninsurance (17.2% and 16.5%), severe overcrowding (7.6% and 9.7%), and service workers (49.6% and 48.5).

-

95.3% of Jamaica/Hollis residents are people of color, 42.9% are service workers, and the district ranks among the highest for threats to homeowners, with 518 foreclosure filings and 73.8% of home purchase loans made by non-bank lenders.

-

Queens Village (CD 13) and Rockaway/Broad Channel (CD 14) also ranked highly for threats to homeowners, and Rockaway/Broad Channel also experienced among the highest increases in residential sale prices – 18.3%.

-

Staten Island

-

All three Staten Island community districts ranked in the top 10 for COVID case rates – 138.8 per 1,000 people in Stapleton/St. George (SI 1), 141.3 in South Beach/Willowbrook (SI 2), and 150.7 in Tottenville/Great Kills (SI 3) – but none of them ranked among the highest citywide for death rates. Those districts have low rates of insurance, severe crowding, and service workers, a low BIPOC population, and relatively high area median incomes.

-

Stapleton/St. George experienced high rates of pre-pandemic evictions (0.3 per 1,000 people), increases in residential sale prices (12.2% increase per gross square foot between 2018-2020), expiring LIHTC units (141), foreclosure filings (225), and non-bank home loans (55.0%).

-

Tottenville/Great Kills also showed high risks to homeowners, with 160 foreclosure filings and 52.1% of loans made by non-bank lenders.

Data Table of 2021 Housing Risk

Data Sources & Definitions

Note on Community District and PUMA Geographies

Most data are aggregated by community districts, but indicators from the American Community Survey are aggregated by Public Use Microdata Areas (PUMAs). PUMAs are designed by the U.S. Census Bureau and approximate New York City’s community districts (CDs). However, their boundaries do not coincide precisely with community districts boundaries. There are 59 community districts in New York City, but only 55 Sub-Borough Areas/ PUMAs; four pairs of community districts were combined by the Census Bureau to improve sampling and protect the confidentiality of respondents. These pairs are Mott Haven/Melrose (BX 1) and Hunts Point/Longwood (BX 2), Morrisania/Crotona (BX 3) and Belmont/East Tremont (BX 6), the Financial District (MN 1) and Greenwich Village/Soho (MN 2), and Clinton/Chelsea (MN 4) and Midtown (MN 5). Click here for a map of PUMA and Community District boundaries.

The following data definitions are for ANHD’s 2021 affordable Housing Risk Chart. Email comms@anhd.org with questions.

COVID-19 Case Rate (per 1,000 People), February 2020 – April 2021

The number of positive COVID-19 tests between February 29, 2020 and April 17, 2021 divided by the population of the corresponding PUMA. The resulting figure is multiplied by 1,000 to find cases per 1,000 people. For community districts that are combined to make a PUMA (see notes above), the cases for both CDs are summed and divided by the PUMA population. Source: Direct from NYC Department of Health and Mental Hygiene (DOHMH) and U.S. Census American Community Survey (ACS) 2019 1-Year Estimates, Total Population.

COVID-19 Death Rate (per 1,000 People), March 2020 – April 2021

The number of confirmed deaths due to COVID-19 between March 11, 2020 and April 17, 2021 divided by the population of the corresponding PUMA. The resulting figure is multiplied by 1,000 to find deaths per 1,000 people. For community districts that are combined to make a PUMA (see notes above), the deaths for both CDs are summed and divided by the PUMA population. Source: Direct from NYC DOHMH and ACS 2019 1-Year Estimates, Total Population.

Percent Uninsured, 2019

Percent of population with no health insurance coverage. Source: ACS 2018 5-Year Estimates, Health Insurance.

Percent with Severe Overcrowding, 2019

Percent of renter households with 1.5 or more occupants per room. Source: ACS 2019 5-Year Estimates, Occupants Per Room (Renter-Occupied Housing Units).

Percent Service Workers, 2019

Percent of employed civilian population 16 years and over in Service and Production, Transportation, and Material Moving Occupations. Source: ACS 2019 1-Year Estimates, Occupation for Employed Civilian Population 16 Years and Over.

Percent People of Color, 2019

Percent of population identifying as Black or African American, American Indian and Alaska Native, Asian, Native Hawaiian and other Pacific Islander, some other race alone, or two or more races. This is the same as the population identifying their race as anything other than White Alone. This definition of people of color includes those who identify as Latinx as their ethnicity and any race other than White. ACS 2019 1-Year Estimates, Race.

Percent of Area Median Income, 2019

To calculate the local Area Median Income (AMI) level, the 2019 median household income of a PUMA is adjusted/prorated by its average household size and compared to the HUD-determined income limits for the entire New York Metro Fair Market Rent Area in 2019. The area median income for a 4-person household in 2019 was $106,700. Source: American Community Survey (ACS) 2019 1-Year Estimates, Average Household Size, Median Household Income and U.S. Department of Housing and Urban Development 2019 Income Limits Documentation.

Percent with Rent Burden, 2019

Percent of households paying 30% or more of income towards gross rent. Source: ACS 2019 1-Year Estimates, Gross Rent as a Percentage of Household Income.

Rate of Residential Evictions (per 1,000 People), 2020

Number of individual evictions executed by court-ordered marshals, divided by the population of the corresponding PUMA. The resulting figure is multiplied by 1,000 to find evictions per 1,000 residents. For community districts that are combined to make a PUMA (see notes above), the evictions for both CDs are summed and divided by the PUMA population. We de-duplicate records with identical addresses, unit numbers, eviction date, and marshal last names. Note that because of restrictions on the execution of evictions during the COVID-19 pandemic, numbers only reflect the months of January through late March and are significantly lower than 2019. This indicator does not reflect housing court filings, only executed evictions. Source: NYC Department of Investigations Evictions data, data cleaning via ANHD’s DAP Portal, and U.S. Census American Community Survey (ACS) 2019 1-Year Estimates, Total Population.

Number of Housing Litigations, 2020

Housing Court actions initiated by HPD against owners of privately-owned buildings or initiated by tenants against private owners. Source: NYC HPD Litigations data.

Rate of Serious Housing Code Violations in 6+ Unit Buildings (per 1,000 Units), 2019

Newly issued Class C violations of the Housing Maintenance Code issued by HPD in properties with 6 or more residential units. This figure is divided by all residential units in 6+ unit properties in the corresponding community district and then multiplied by 1,000 to find the rate of serious violations per 1,000 residential units. Source: NYC HPD Housing Maintenance Code Violations and New York City Department of Planning’s PLUTO 20v8 database.

Rate of Unplanned NYCHA Service Outages (per 1,000 Units), 2020

Number of unplanned service outages between April 1, 2020 and March 31, 2021 per 1,000 units in New York City Housing Authority developments in the corresponding community district. A value of ‘-’ indicates there is no data available; these districts likely have no NYCHA housing. Source: NYCHA Service Disruptions scraped by the Housing Data Coalition and Development Data Book data.

Number of SCRIE/DRIE Recipients, 2020

Tenants with active Disability Rent Increase Exemption (DRIE) or Senior Citizen Rent Increase Exemption (SCRIE) benefits. DRIE and SCRIE are only available to tenants in rent-stabilized buildings and freezes the rent for qualifying tenants by offsetting increases with reductions in property taxes. Source: Direct from NYC Department of Finance (DOF).

Percent Change in Avg Price per Sq Ft of Residential Sales, 2018-2020

Change in average gross price per square foot of residential buildings of all unit sizes from 2018 to 2020 for each community district. Sale prices of $100,000 or less, sales with recorded gross square footage of less than 500 sq ft, and buildings containing commercial units are excluded. Community districts lacking enough sales records to calculate a change show a value of ‘-’. Note that some districts, especially in Manhattan, have a low sale volume, and building sizes and types vary among districts. Source: NYC DOF Rolling and Annualized Sales.

Number of Units in New Buildings issued Certificates of Occupancy, 2020

Number of residential units in all new buildings issued Certificates of Occupancy. Source: NYC Department of Buildings Certificates of Occupancy data.

Number of Rent Stabilized Apartments, 2019

Number of rent-stabilized apartments as registered with the New York State Division of Homes and Community Renewal and pulled from NYC DOF property tax bills. These numbers include properties with 421a and J-51 tax abatements as well as other regulatory programs requiring rent stabilization. Source: NYCDB.

LIHTC Units Eligible to Expire, 2022-2026

Number of units in buildings receiving Low Income Housing Tax Credits (4% or 9%) that are eligible to expire between December 31, 2021 and December 31, 2025, inclusive. Data is current as of June 2020 Source: NYU Furman Center’s CoreData.nyc.

Number of Foreclosure Filings, 2020

Mortgage-related foreclosure filings, also called lis pendens or pre-foreclosures, for all building and property types. During the COVID-19 pandemic foreclosures could not be executed, but foreclosure processes were initiated. Source: PropertyShark.

Share of 1-4 Unit Non-Bank Home Purchase Loans, 2019

Number of 1-4 unit home purchase loans made by independent lenders (non-bank, excluding credit unions), who are not covered by the Community Reinvestment Act, as a share of all 1-4 family, owner-occupied, first-lien loans. Source: Home Mortgage Disclosure Act (HMDA).