About the Housing Risk Chart

On this page, you can find our key findings from the 2023 Housing Risk Chart, an interactive and downloadable data table, and full data notes and definitions.

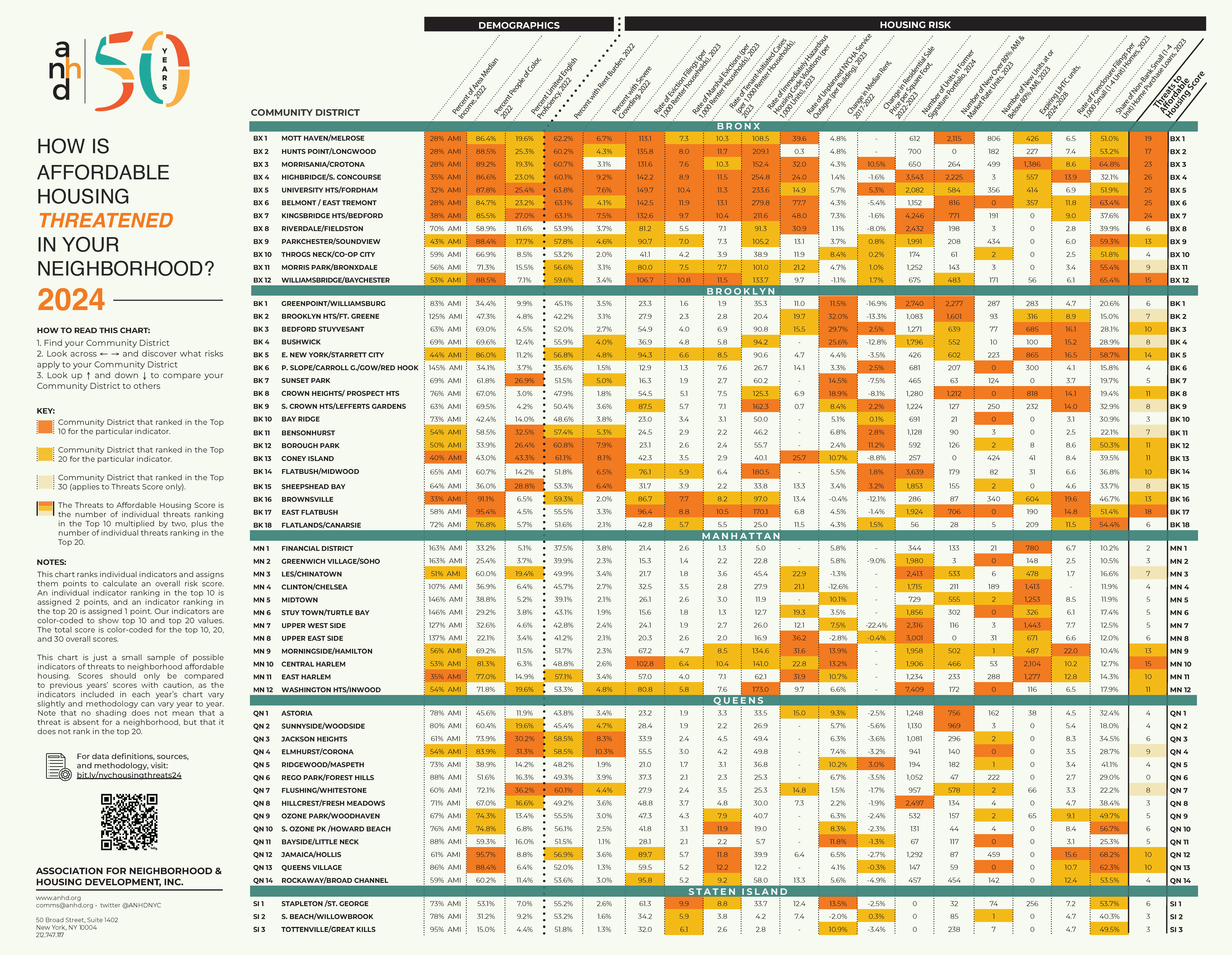

The Housing Risk Chart uses color coding to highlight the highest levels of risk in each district: when a value is orange, it means that Community District ranks in the top ten citywide for that risk. When it’s yellow, it ranks in the top twenty. The last column, the Threats to Affordable Housing Score, tallies up an overall risk score by assigning districts two points for each indicator that ranks in the top ten and one point for each indicator that ranks in the top twenty.

About CHPSI

The Housing Risk Chart is funded by the Community Housing Preservation Strategies Initiative (CHPSI). For over 15 years, through CHPSI, the New York City Council has supported two programs to ensure organizations across community districts can work in their neighborhoods to combat the loss of affordable housing in their community:

-

The Housing Preservation Initiative (HPI) directly addresses threats to each neighborhood’s affordable housing stock by working with community residents to create neighborhood-based solutions.

-

The Community Consultant Contract (CCC) supports front-line anti-displacement services and specialists who work with community residents and constituent services to fight evictions and foreclosures.

The Risk Chart makes clear the importance of targeted and individualized programs like HPI and CCC, which allow over 40 community-based organizations to work at a neighborhood level to address specific threats to affordable housing and housing stability.

Key Findings

General

Tens of thousands of units across four boroughs were financed by Signature Bank before it collapsed.

Units that were in Signature Bank’s portfolio before it collapsed are distributed across all boroughs except Staten Island, but are most concentrated in Manhattan, Brooklyn, and the Bronx. Community districts with especially high numbers of former Signature units are Washington Heights/Inwood (MN 12) with 7,409 units, Kingsbridge Heights/Bedford (BX 7) with 4,246 units, Flatbush/Midwood (BK 14) with 3,639 units, and Highbridge/South Concourse (BX 4) with 3,543 units. Those four districts all rank in the top twenty for overall housing risk and have high numbers of severe crowding, evictions, and hazardous housing code violations.

Before its collapse, Signature Bank was the second-largest multifamily lender in New York City. Signature was notorious for lending to some of the city’s worst landlords with speculative loans that overleveraged buildings and relied on the displacement of long-time, low-income tenants to turn a profit. ANHD has been raising the alarm on Signature Bank’s bad lending practices for years, and the collapse of the bank presents an opportunity for tenants to organize and push new mortgage holders for better conditions in their buildings.

Six districts across four boroughs show particularly inequitable new housing development.

This year, ANHD included two complimentary metrics to examine what type of housing is being added in each community district:

Number of New Over 80% AMI & Market Rate Units in 2023 is aimed at understanding how many “high-rent” housing units were added in each community district, whether they are classified as “affordable” but targeted to households making over 80% AMI or whether they are unregulated, market-rate units. In 2023, a two-bedroom unit over 80% AMI had a rent of more than $2,542. Higher risk for this indicator is assigned to community districts with more high-rent units added in 2023.

Number of New Units at or Below 80% AMI in 2023 shows how much “lower-rent” housing was added at 80% AMI or below – meaning the maximum rent for a two-bedroom unit was $2,542. While $2,542 is still quite high, available data did not allow for disaggregation without excluding all “Low Income” affordable units between 51% and 80% AMI, so we chose to include them. Higher risk is assigned to community districts with fewer lower-rent units added in 2023.

Examining these two indicators along with Percent of AMI and other demographic indicators further illustrate which neighborhoods are enduring development that does not serve existing residents. The following districts had large numbers of high-rent units added, negligible lower-rent units added, and their district median income equates to less than 80% AMI. Except for one (MN 3), they all have above-average populations of people of color.

For the third year in a row, evictions soared – especially in communities of color.

The 2024 Housing Risk Chart once again shows that eviction filings – along with evictions ordered by court-ordered marshals – primarily occur in neighborhoods that are mostly people of color and have some of the lowest incomes in New York City, and they have continued to accelerate since pandemic-era protections expired in January 2022.

-

While the top ten eviction filing rates varied from 37.2-40.8 in 2021 and 83.0-121.3 in 2022, they ranged from 96.4-149.7 per thousand renter households in 2023. The rapid escalation of eviction cases has overwhelmed housing courts, tenants, and attorneys.

-

Like last year, eight of the top ten CDs with the highest rates of eviction filings were in the Bronx (BX 1-7 and 12) and one was in Brooklyn (East Flatbush, BK 17). In contrast from previous years, Central Harlem (MN 10) had one of the highest eviction filing rates as well.

Evictions are highly correlated with race, echoing ANHD’s previous research. All of the top ten CDs with the highest rates of eviction filings and nine of the top ten CDs with the highest rates of marshal evictions are over 80% people of color (compared to 69.1% citywide).

Bronx

As in previous years, Bronx districts rank highest for threats to affordable housing citywide and seven of its districts rank in the top ten for overall risk citywide. Compounding risk factors point to long-standing divestment from Bronx communities, particularly those with the highest shares of people of color.

-

Bronx districts 1 through 7, spanning west of the Bronx River up to Woodlawn Cemetery, all rank in the top ten overall threats to affordable housing.

-

BX 1-7 and Williamsbridge/Baychester (BX 12) rank particularly high for rent burden (59.6%-63.8%), eviction filings (106.7-149.7 per 1,000 renter households), marshal evictions (7.3-11.9 per 1,000 renter households), tenant-initiated housing court cases (10.3-13.1 cases per 1,000 renter households), and immediately hazardous housing violations (108.5-279.8 per 1,000 units in 6+ unit buildings).

-

Those same districts have among the lowest incomes (31% AMI-59% AMI), highest shares of people of color (84.7%-89.2%), and highest shares of limited English proficiency (19.6%-27.0%, excluding BX 12).

Brooklyn

-

Brooklyn neighborhoods saw by far the highest increases in median rents in recent years (adjusting for inflation). Brooklyn was the only borough with neighborhoods seeing an over 20% increase in rents, reaching up to 32.0% in Brooklyn Heights/Fort Greene (BK 2), 29.7% in Bedford Stuyvesant (BK 3), and 25.6% in Bushwick (BK 4). Greenpoint/Williamsburg (BK 1), Sunset Park (BK 7), and Crown Heights (BK 8) also ranked in the top ten citywide for rent increases, all upwards of 10%.

-

Several low and lower-income neighborhoods in Brooklyn saw significant additions of high-rent units without large numbers of lower-rent units. Crown Heights added 1,212 high-rent units and zero lower-rent units. East Flatbush (BK 17) added 706 high-rent units and zero lower-rent units. Bedford Stuyvesant added 639 high-rent units and 77 lower-rent units. Bushwick added 552 high-rent units and 10 lower-rent units.

-

Brooklyn has among the highest rates of foreclosure filings in any borough, with seven of its districts ranking in the top ten citywide, ranging from 14.0 foreclosures per 1,000 small homes in South Crown Heights/Prospect Heights (BK 9) to 19.6 in Brownsville (BK 16).

Manhattan

New York City’s most affluent borough shows higher housing risks than in recent years, with the highest risk in Upper Manhattan. Central Harlem (MN 10) ranked in the top ten for overall risk and Morningside/Hamilton Heights (MN 9), East Harlem (MN 11), and Washington Heights/Inwood (MN 12) ranked in the top twenty. Those districts have incomes ranging from 39% AMI-62% AMI and above-average populations of people of color (69.2-81.3%).

-

Manhattan districts had high rates of unplanned NYCHA service outages, with seven out of twelve districts ranking in the top twenty and three in the top ten: 36.2 per building on the Upper East Side (MN 8), 21.9 in East Harlem, and 31.6 in Morningside/Hamilton Heights. Rates of NYCHA outages in Manhattan were surpassed only by rates in the Bronx.

-

Manhattan has the largest number of units formerly in the Signature Bank portfolio: 26,861 out of 79,488 citywide (33.8%). There are 7,409 former Signature units in Washington Heights/Inwood, 3,001 units on the Upper East Side, 2,413 units on the Lower East Side/Chinatown (MN 3), and 2,316 units on the Upper West Side (MN 7).

-

Manhattan has the largest number of LIHTC units subject to expire in the next five years: 10,496 out of 19,026 units citywide (55.2%). There are 2,104 units set to expire in Central Harlem, 1,443 units on the Upper West Side, and 1,413 units in Clinton/Chelsea (MN 4).

Queens

Overall, the borough of Queens has fewer high-risk districts than the Bronx, Brooklyn, and Manhattan. The highest-risk districts are Jamaica/Hollis (QN 12) and Queens Village (QN 13) in the top twenty, and Elmhurst/Corona (QN 4) and Flushing/Whitestone (QN 7) ranked in the top 30.

-

Of all boroughs, Queens added the fewest new units of lower-rent housing in 2023. Queens added 1,003 of 6,251 units citywide, or just 16.0%. Ten out of fourteen districts added no more than 4 new units. The districts that did add higher numbers of lower-rent units were Jamaica/Hollis (QN 12) with 459 new units, Rego Park/Forest Hills (QN 6) with 222 new units, Astoria (QN 1) with 162 new units, and Rockaway/Broad Channel (QN 14) with 142 new units.

-

Inflation-adjusted median rents increased in every Queens community district from 2017-2022, ranging from 1.5% in Flushing/Whitestone to 11.8% in Bayside/Little Neck (QN 11).

-

At the same time, residential sale prices decreased in every community district in Queens from 2022-2023, with the exception of Ridgewood/Maspeth (QN 4), where the price per square foot increased by 3.0%.

-

Rates of tenant-initiated housing court cases were high in Queens, with five districts ranking in the top twenty citywide. Queens Village had 12.2 cases per 1,000 renter households, South Ozone Park/Howard Beach (QN 10) had 11.9, and Jamaica/Hollis had 12.2.

-

Two districts show a close correlation between the proportion of people of color and risk to homeownership like foreclosures and non-bank loans. Jamaica/Hollis, where 95.7% of the population is people of color, had 15.6 foreclosures per 1,000 small homes and 68.2% of loans were made by non-bank lenders. Queens Village, where 87.8% of the population is people of color, had a foreclosure rate of 10.7 and 62.3% non-bank loans. High foreclosure rates and shares of non-bank loans, which are generally higher-cost and potentially predatory, in communities of color reinforce historic redlining and deprivation of access to homeownership and wealth-building.

Staten Island

-

While risks in Staten Island were low compared to other boroughs, there were still high rates of some risk factors, especially in Stapleton/St. George (SI 1) – which also has the lowest income (81% AMI) and highest proportion of people of color (53.1%) in the borough.

-

All three Staten Island districts ranked in the top twenty for rates of residential marshal evictions, from 5.9 per 1,000 renter households in South Beach/Willowbrook (SI 2) to 9.9 in Stapleton/St. George.

-

Stapleton/St. George saw a 13.5% increase in median rents from 2017-2022, and Tottenville/Great Kills saw a 10.9% increase.