The ANHD Blog raises the profile of our issues, and educates our member groups, city decision makers, and the general public on our core issue areas. The ANHD Blog offers sharp, timely and effective commentary on key public policy issues, as well as our work and the work of our member groups.

All of our blogs are sorted based on the issues, projects, special tags, and dates they are associated with, and you can use the dropdowns below to filter through our blogs based on these tags. Additionally, you can do a general search through our blog, using the search bar the right. If you can’t find what you are looking for, email comms@anhd.org.

Fund Truly Affordable Housing, Not Luxury Development

The 421-a tax exemption, which has subsidized luxury housing development for decades, is currently set to sunset this year. Governor Hochul’s proposed replacement (485-w) proposal is a sugar-coated version of 421-a that is ultimately still a massive giveaway to luxury developers - not an affordable housing program. As we enter the final week of negotiations around the New York State budget, ANHD explores why we need to reject 485-w, let 421-a expire, and instead focus funding and policy on true affordable housing programs.

The 421-a tax exemption, which has subsidized luxury housing development for decades, is currently set to sunset this year. Governor Hochul’s proposed replacement (485-w) proposal is a sugar-coated version of 421-a that is ultimately still a massive giveaway to luxury developers - not an affordable housing program. The state legislature needs to reject 485-w, let 421-a expire, and use the revenue to fund truly affordable housing and end homelessness.

421-a is not an affordable housing program.

When 421-a was created 50 years ago, it was designed as a general housing supply booster, not an affordable housing program. The city’s population was shrinking and housing development lagged. It was meant to attract middle and upper class households. The current 421-a program and the 485-w program proposed by the Governor continue this legacy.

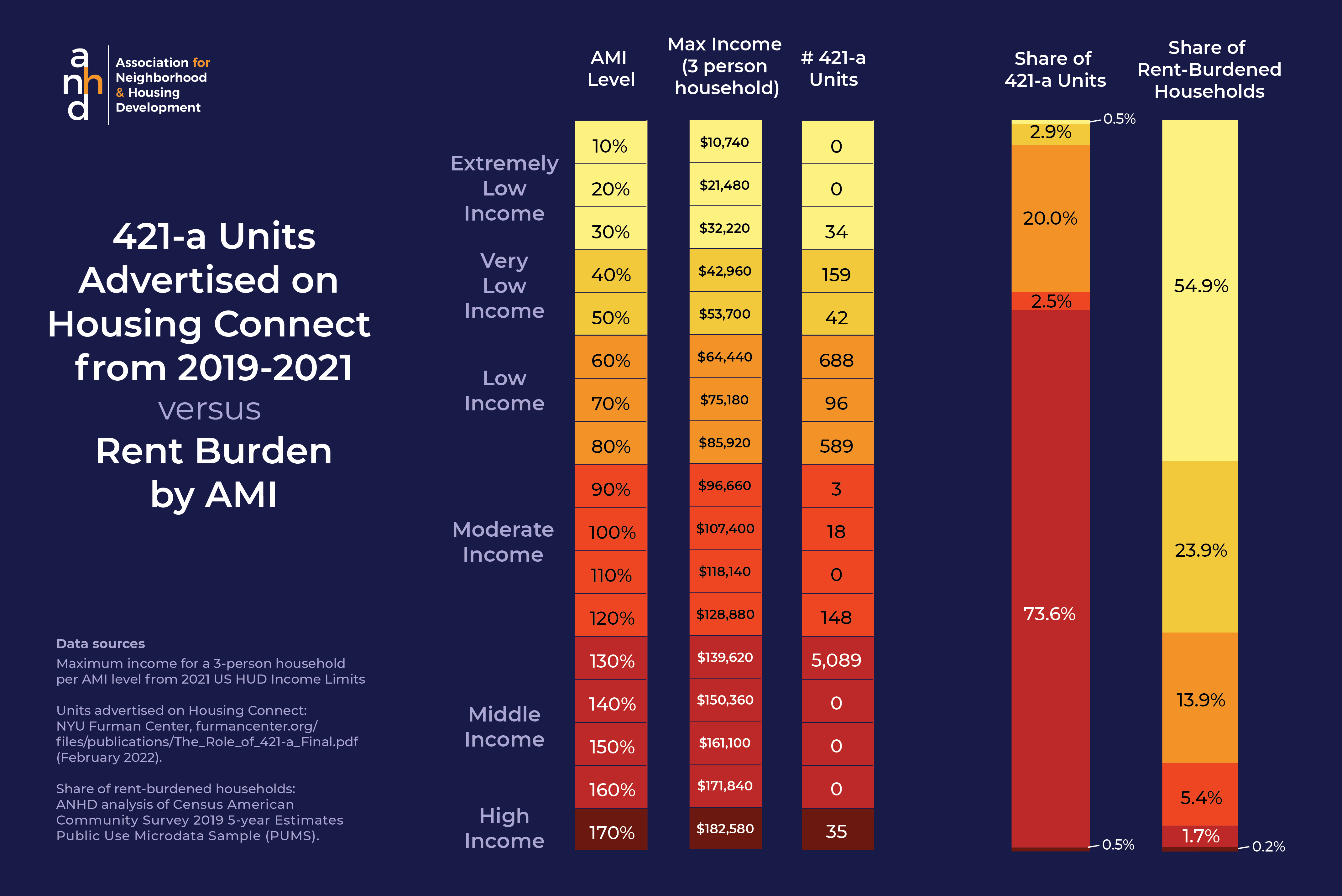

The current iteration of 421-a was renamed the “Affordable New York” Housing Program in 2017, but this “affordable” program definitively does not meet the needs of low-income and working class renters. This version of 421-a currently in place allows developers full tax exemptions to build rental apartments up to 130% AMI, or approximately $140,000 for a household of three. As a result, nearly three-quarters of the “affordable” units marketed on Housing Connect since 2019 were targeted at households making 130% of Area Median Income (AMI).[1] This is a blatant mismatch with which households actually need affordable housing: less than 1% of New York City’s rent-burdened households make 130% AMI (see our 2021 AMI Cheat Sheet).

In comparison, more than three quarters of rent-burdened New Yorkers make less than 50% AMI, but such apartments made up just 3.4% of 421-a units marketed on Housing Connect during the same time period. Affordable New York builds apartments for rich households, not the low-income and working-class New Yorkers who need them.

The Governor’s 485-w proposal is a sugar-coated 421-a.

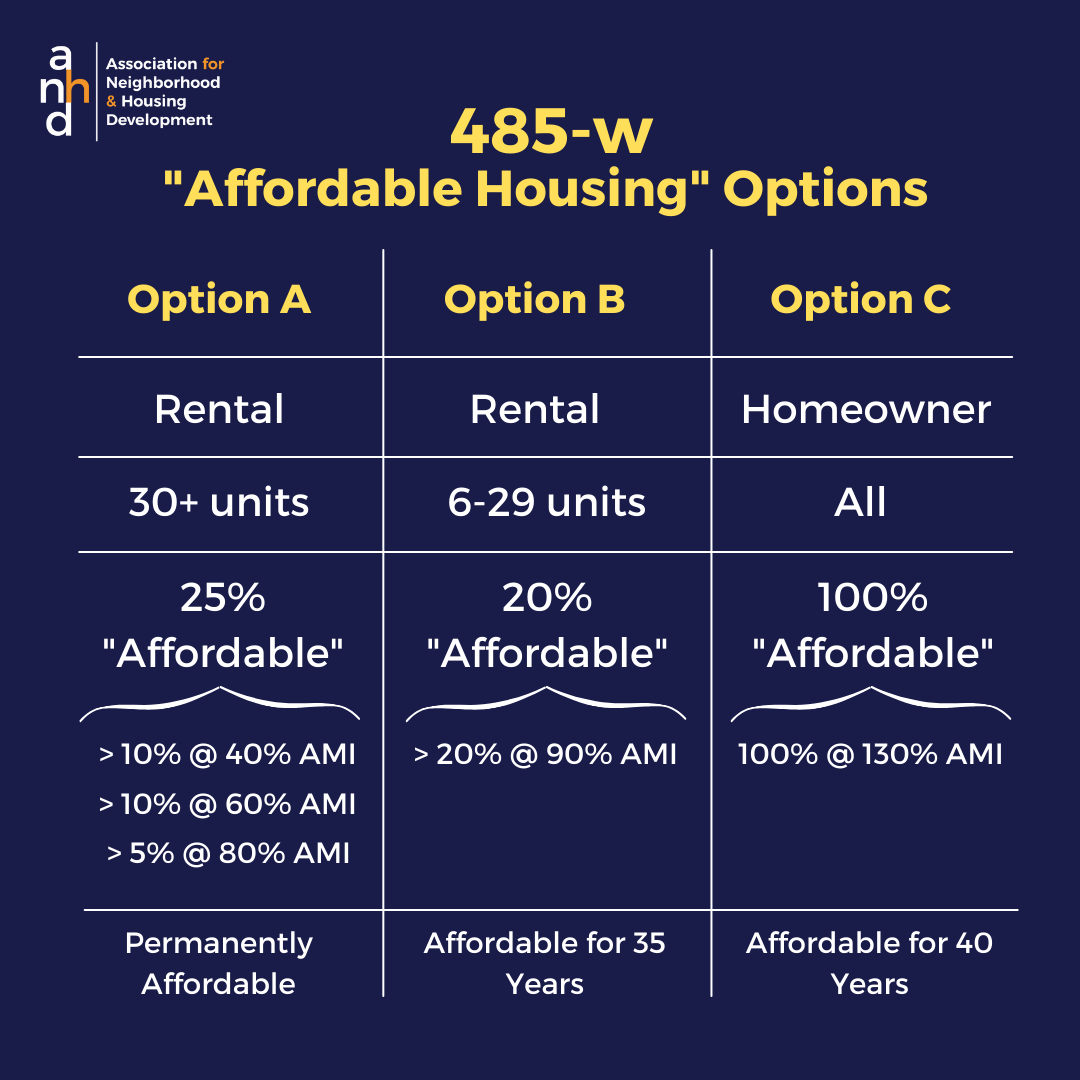

Governor Hochul has proposed a new tax exemption program called “Affordable Neighborhoods for New Yorkers” or 485-w, but this is just a sugar coated version of 421-a. Like 421-a, this “affordable” program is primarily a giveaway to private developers, not an incentive to create the kind of affordable housing New York needs. The Governor’s program does not change the fundamental structure of 421-a, in which public resources in the form of lost tax revenue are used to largely subsidize market-rate housing.

Under the governor’s proposal, developers can still receive a full tax abatement for a building with 20% of units targeted to households at 90% of AMI, or $96,660 for a 3-person household, and the rest of the building unrestricted (Option B). Our analysis found that average rent for a 90% AMI 2-bedroom apartment, currently $2,323, is higher than the actual median rent of a two-bedroom in 92% of New York City’s Census tracts. As evidenced by the 2017 version of 421a, developers consistently choose the option that offers the highest AMI targets, meaning developers will likely choose Option B among the rental options in the Governor’s proposal. This means more units at 90% AMI and fewer units overall, since Option B is for smaller buildings. Instead of creating necessary affordable housing, 485-w would create housing that is more expensive than normal rent in most of New York City.

The governor’s proposal also includes tax exemption for condominium development, but one that does nothing to support homeownership opportunities for most New Yorkers. In the proposal, co-op and condo properties would be eligible for Hochul’s proposed exemption for a for units are restricted to buyers earning at or below 130% AMI - an income of $139,620 - for 40 years, with the owners only having to use the home as their primary residence for 5 years.

Just as 421-a has been labeled an “affordable” housing program but has actually encouraged luxury development, 485-w would be a big giveaway to real estate developers without requiring a real public benefit in return. We don’t need a 421-a program with a different name - we need truly affordable housing and protections for tenants statewide.

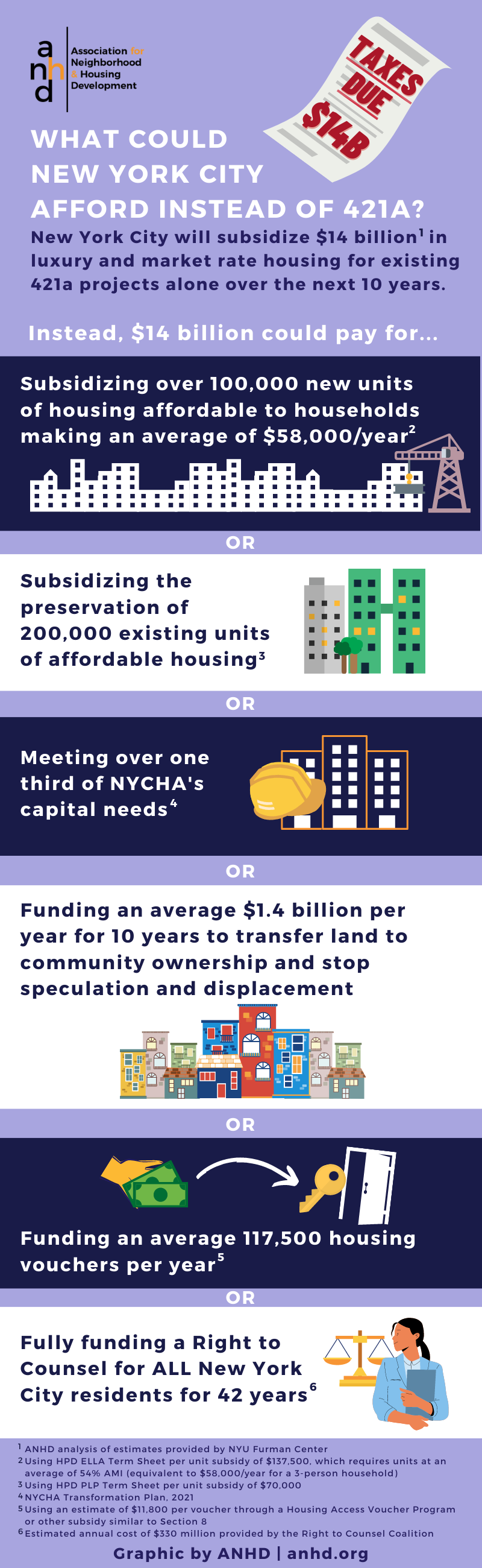

421-a is a tax burden on NYC

421a is not only bad housing policy, it’s an enormous waste of public money. 421-a is the City’s single largest expenditure on housing, costing approx $1.7 billion per year; that is more than tenant vouchers, NYCHA, and subsidies for affordable housing development[2]. Given existing 421-a developments, New York City is already stuck subsidizing $14 billion in luxury and market rate housing over the next 10 years.[3] We simply can’t afford to keep adding to this price tag while starving actual affordable housing programs of desperately needed resources.

That same $14 billion could:

- Subsidize over 100,000 new units of housing affordable to households making an average of $58,000/year[4] OR

- Subsidize the preservation of 200,000 existing units of affordable housing[5] OR

- Meet over one third of NYCHA’s total capital needs[6] OR

- Fund an average $1.4 billion per year to transfer land to community and tenant ownership and stop speculation and displacement OR

- Distribute an average 117,500 housing vouchers per year[7] OR

- Fully fund a right to counsel for all New York City residents for 42 years[8]

An actual affordable housing strategy for New York

New York had a longstanding affordability crisis even before the Covid-19 pandemic exacerbated racial and economic inequalities and pushed even more households to the brink of homelessness. Hundreds of thousands of New Yorkers remain behind on rent and risk being evicted. Tens of thousands more are homeless. Now more than ever, we need to target public policy and public money towards developing affordable housing that will actually help to alleviate homelessness and prevent displacement.

421-a and 485-w are developer giveaways masquerading as affordable housing policies. New Yorkers need and deserve better. Policies like Good Cause Eviction protections and Housing Assistance Vouchers would actually help to end the statewide affordability crisis and help New Yorkers who are homeless or at risk of displacement secure safe, affordable housing. It’s up to the legislature to turn away from 421-a and its look-alikes and towards truly affordable housing.

[1] NYU Furman Center report, 2022, https://furmancenter.org/files/publications/The_Role_of_421-a_Final.pdf. Note: There is no readily available source of AMI levels associated with individual 421-a developments. In their analysis, the Furman Center reviewed affordability levels of 421-a units marketed on Housing Connect to gather this data. Furman found that units marketed since 2019 were more reflective of the Affordable New York program options than earlier listings.

[2] Community Service Society report, 2022: https://smhttp-ssl-58547.nexcesscdn.net/nycss/images/uploads/pubs/421a_at_50.pdf

[3] ANHD analysis of estimates provided by the NYU Furman Center. See also https://furmancenter.org/files/publications/The_Role_of_421-a_Final.pdf, p.22.

[4] Using HPD ELLA Term Sheet per unit subsidy of $137,500, which requires units at an average of 54% AMI (equivalent to $58,000/year for a 3-person household)

[6] NYCHA Transformation Plan, 2021

[7] Using an estimate of $11,800 per voucher through a Housing Access Voucher Program or other subsidy similar to Section 8

[8] Estimated annual cost of $330 million provided by the Right to Counsel Coalition