Banks Pulling Back and Non-Bank Lenders Step In

1-4 family lending continues to be dominated by a few large banks, but non-bank lenders are increasing their presence, which is concerning. Independent mortgage companies and credit unions are not covered by the CRA, but credit unions have much smaller share than either banks or non-bank lenders. In 2014, 29.4% of all home purchase loans were originated by non-CRA covered lenders, up from 22.6% in 2011. The percentage of non-CRA covered lenders was 45.4% for refinance loans. In fact, online lender Quicken Loans originated the most refinance loans in the city in 2014.

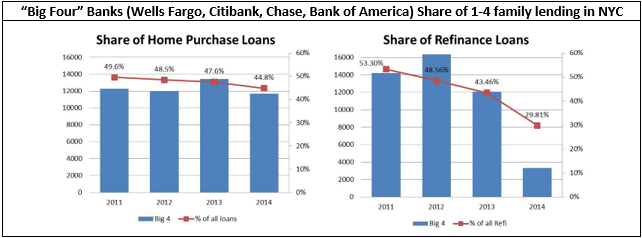

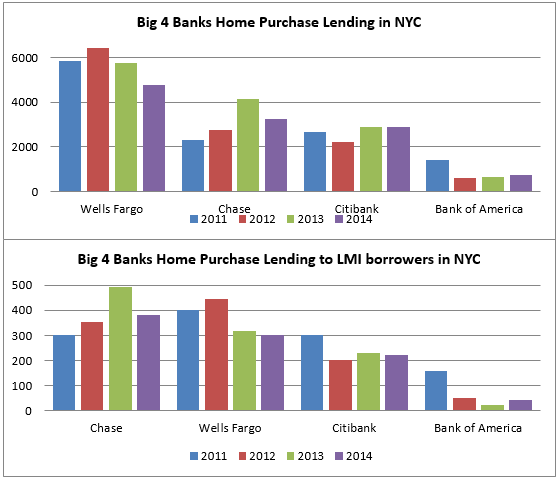

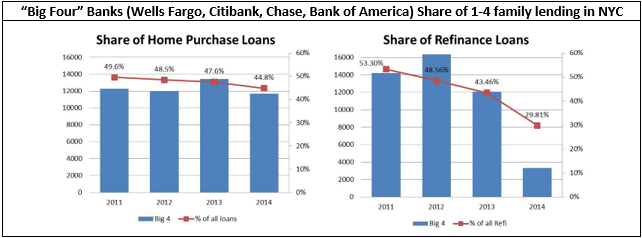

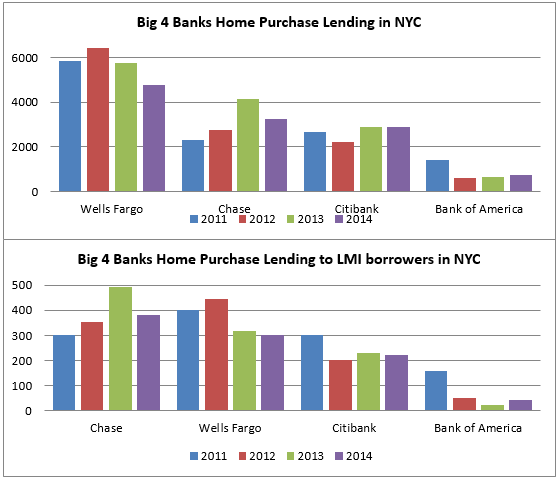

The “Big 4” banks’ – Wells Fargo, Citibank, Chase, and Bank of America – share of lending has been declining in NYC and nationwide. Collectively they accounted for 45% of home purchase loans in the City in 2014, down from 50% in 2011. They dropped from 53% to 30% of refinance loans in that same period. Historically HSBC had been among the top lenders in NYC, but their volume has dropped considerably over the years. While Wells Fargo has only 22 full service branches in NYC, they have additional mortgage offices and a very large presence in the mortgage market. Wells Fargo made 18% of all home purchase loans in the City and 14% of all loans to LMI borrowers in 2014, similar to 2013. In 2012, however, they made closer to 25% of all loans and 19% of loans to LMI borrowers). Chase has a much larger branch presence than any other bank in the city. In 2013, they made 14.6% of all home purchase loans and 21% of loans to LMI borrowers. In 2014, that dropped to 12.5% of all loans citywide and 17.6% of loans to LMI borrowers.

We recognize that some of the smaller banks face unique challenges in competing with the larger national and regional banks, especially those that may not have the branch and office presence or budgets to compete. Nevertheless, like all banks, they have an obligation to lend equitably where they do lend. Thus, it is concerning the number of bank lenders that are pulling out of 1-4 family lending. Dime discontinued its 1-4 family lending in 2015; BankUnited announced the same in 20163 , and Apple, Flushing and Signature already make a very low volume, as they concentrate lending in other areas. While not every bank will engage in every area of CRA, this contributes to the trend of fewer and fewer CRA-covered bank lenders in the market.

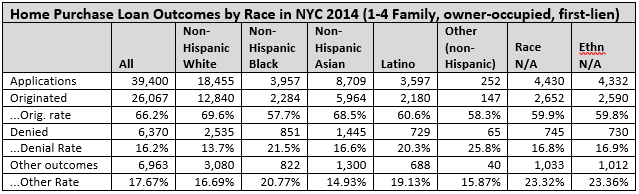

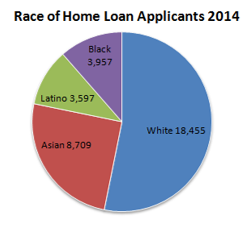

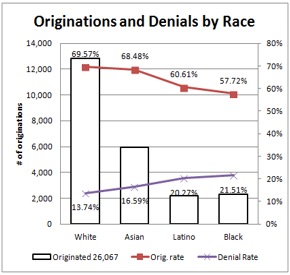

Racial disparities persist in home lending. 22% of New Yorkers are Black and 29% Latino, yet in 2014, only 8.36% of home purchase loans in NYC went to non-Hispanic Black Borrowers and 8.36% to Hispanic borrowers of any race. There is also a vast disparity in the number of home purchase loan applications among racial groups. Blacks only submitted 10% of all applications and Hispanics 9% in 2014. Likewise, beyond the disproportionately low number of Black and Hispanic applicants, those groups also received comparatively high rates of home purchase loan denials. While only 13.7% of White applications were denied citywide, 21.5% of Black and 20.3% of Hispanic applications were denied.

Racial disparities persist in home lending. 22% of New Yorkers are Black and 29% Latino, yet in 2014, only 8.36% of home purchase loans in NYC went to non-Hispanic Black Borrowers and 8.36% to Hispanic borrowers of any race. There is also a vast disparity in the number of home purchase loan applications among racial groups. Blacks only submitted 10% of all applications and Hispanics 9% in 2014. Likewise, beyond the disproportionately low number of Black and Hispanic applicants, those groups also received comparatively high rates of home purchase loan denials. While only 13.7% of White applications were denied citywide, 21.5% of Black and 20.3% of Hispanic applications were denied. Addressing these disparities will require a concerted effort on the part of government, banks, and bank regulators. This involves increasing the inventory of affordable homes to purchase, making credit available equitably and responsibly, increasing financial assistance, and increasing access to homeownership and financial counseling. It also means holding banks accountable for irresponsible practices that lock lower -income borrowers and people of color out of the housing market.

Addressing these disparities will require a concerted effort on the part of government, banks, and bank regulators. This involves increasing the inventory of affordable homes to purchase, making credit available equitably and responsibly, increasing financial assistance, and increasing access to homeownership and financial counseling. It also means holding banks accountable for irresponsible practices that lock lower -income borrowers and people of color out of the housing market.