Change in NYC Storefront Rents, 2019 - 2022

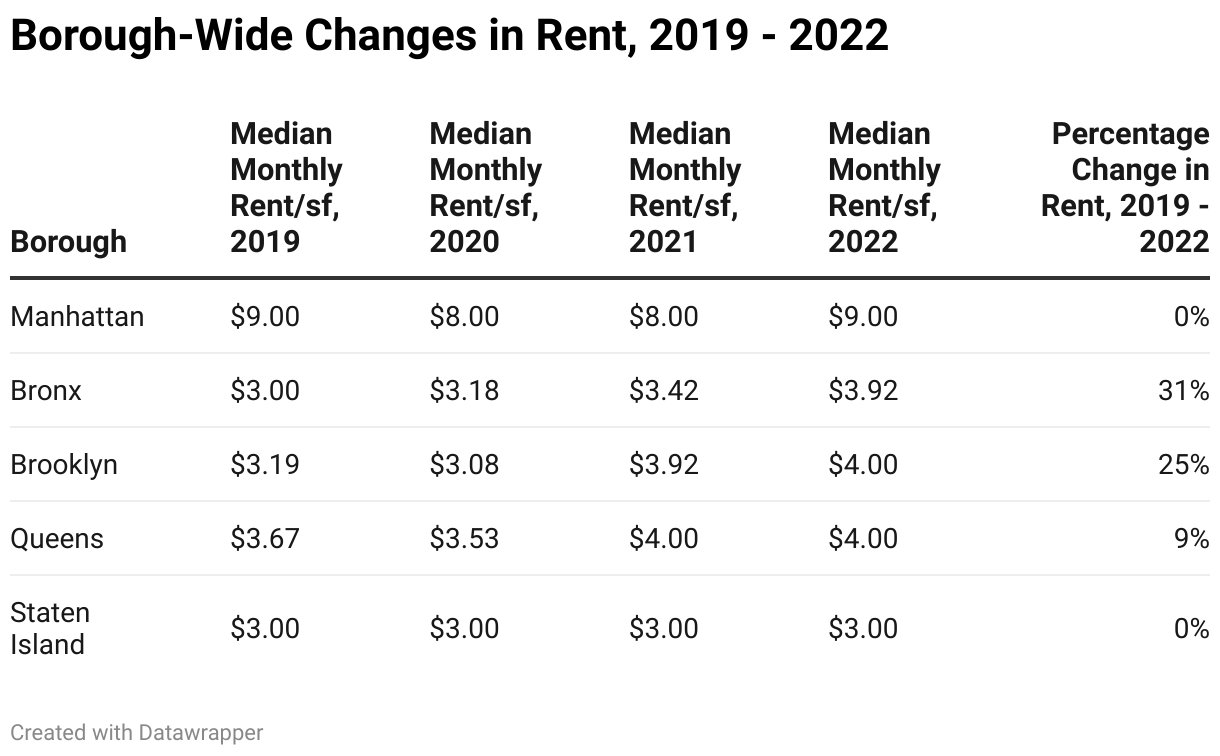

ANHD’s latest map of changes in storefront rents from 2019 to 2022 shows that storefront rents that dipped in 2020, likely due to the economic impacts of the pandemic, are returning to pre-pandemic levels, particularly in Manhattan. While, in much of the Bronx, Brooklyn, and Queens, rents have been rising year over year since 2019.

This analysis follows our 2023 report,the State of Storefronts: Beyond Recovery. The data we analyzed was made available through organizing by the USBnyc coalition to pass Local Law 157 in 2019, which enabled the tracking of rents, vacancies, and other data for ground and second-floor commercial spaces in property tax classes two and four for the first time. (1)

Compared tolast year’s analysis of change in storefront rents from 2019 to 2021, which examined changes in storefront rents from 2019 to 2021, even more Council Districts saw increases in storefront rents by 2022.

In Northeast Queens Council District 19, reported storefront rents increased 33.3% over the three-year period. Previously, by 2021, storefront rents in the same district had only increased 25.3%, indicating that storefront rents are consistently on the rise year over year. Bronx Council Districts 15, 16, and 17 also had significantly high rates of storefront rent increases at 33.3%. Meanwhile, decreasing storefront rents in most parts of Manhattan due to the pandemic appear to have slowed by 2022, with rents in most Manhattan Council Districts stabilizing and returning to 2019 rates.

In the 24 districts where rents increased from 2019 to 2022, 67.8% of the population identified as people of color (POC), compared to 47.5% in the 7 districts where rents decreased during the same period.

Luis Rivera, owner of Casa Adela in the Lower East Side, told us in 2023 that, “the changes in the neighborhood, in particular the rent changes, is what is really hurting us; the rent has gotten so out of hand that some of us will not be able to make it.” The Lower East Side is a neighborhood where average storefront rents may have decreased since the pandemic, but the experiences of merchants who are people of color and immigrants indicate that small businesses throughout New York City are at continued risk of displacement as they struggle to keep their doors open while paying higher and higher rents.

(1) According to the New York City Department of Finance, property tax Class 2 includes primarily residential (rentals, cooperatives, and condominiums) properties, and Class4 includes all commercial and industrial properties, such as office, retail, factory buildings.